PayPal Nonprofit Donation Fees & Its Alternatives [Updated 2025]

In this article, we’ll explain the benefits of using Donorbox to accept PayPal donations and walk you through the steps to set it up.

![PayPal Nonprofit Donation Fees & Its Alternatives [Updated 2025]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2022/04/PayPal-Nonprofit-Donation-Fees-Its-Alternatives-1.png)

In this article, we’ll explain the benefits of using Donorbox to accept PayPal donations and walk you through the steps to set it up.

![PayPal Nonprofit Donation Fees & Its Alternatives [Updated 2025]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2022/04/PayPal-Nonprofit-Donation-Fees-Its-Alternatives-1.png)

PayPal is a trusted global brand and a popular choice for donors. Accepting PayPal donations is an easy way to increase donations, but it isn’t a free option. Like most payment gateways, PayPal deducts a fee from donations before funds are deposited in your organization’s PayPal Account.

What are the PayPal donation fees?

We’ll take you through this, explain the benefits of using Donorbox to accept PayPal donations and much more.

PayPal has recently made changes to its transaction fees for business accounts. The updated rate for PayPal fees is 2.89% + $0.49 per transaction. But for registered charities, PayPal offers a discounted fee of 1.99% + $0.49. Learn in detail here. Check the PayPal processing fees for specific donation amounts in this handy CheckYa PayPal Fee Calculator.

Please note that the fixed part in the above transaction fee is based on the currency received. Also, there’s an additional percentage-based fee of 1.50% for international donations.

Nonprofits need to confirm their charity status to receive PayPal’s nonprofit fees. Learn more about registering your account on PayPal and confirming your charity status here.

Donorbox partners with PayPal to help nonprofits get rid of the processing fees (as well as Donorbox’s platform fee) on donations. With Donorbox, you can enable donors to opt to cover the processing fees. Donors love to help their favorite nonprofits by choosing to cover these fees. Research further says that 53.4% of donations are covered by donors when organizations enable this option on their donation form as default.

Donorbox also offers one of the lowest platform fees in the market while giving tons of customization options to nonprofits, that aren’t available on PayPal. Through this partnership, you can accept donations via PayPal as well as Venmo, and use all of Donorbox’s other features for your nonprofit!

Try Donorbox - Get Started for Free!

We have included a detailed comparison section (and a video) for Donorbox vs. PayPal and the steps to accept PayPal donations on Donorbox in this blog to help you make the right choice.

Before that, let us have a look at the benefits of using PayPal for accepting online donations.

A few benefits of using PayPal for donations include:

PayPal allows your organization to accept online donations but it isn’t optimized for nonprofits. Donor management isn’t possible if you’re only using PayPal and recurring donations are limited to the monthly interval. A customizable donation form and donation page is the basic need for every nonprofit but with PayPal, it is not attainable.

It makes a difference to choose an all-in-one online fundraising platform that’s simple and quick and gives you tons of customization options over PayPal which doesn’t.

On top of everything, PayPal charges 1.99% + $0.45 as their processing fee for eligible nonprofits. Their processing fee for other nonprofits remains at 2.89% + $0.45. Donorbox, on the other hand, takes only 2.95% with its Standard plan (no setup fee, no monthly fees, no contract).

There are many reasons why nonprofits choose donation pages over PayPal donate buttons. The primary reason is the lack of customizations available for PayPal donate buttons. Hence, to offer you the best of both worlds, we’ve partnered with PayPal to allow organizations to accept PayPal donations and take advantage of our fundraising and donor management features.

We have put together an in-depth comparison video on how Donorbox is a better solution for your fundraising needs than PayPal:

Start Fundraising With Donorbox

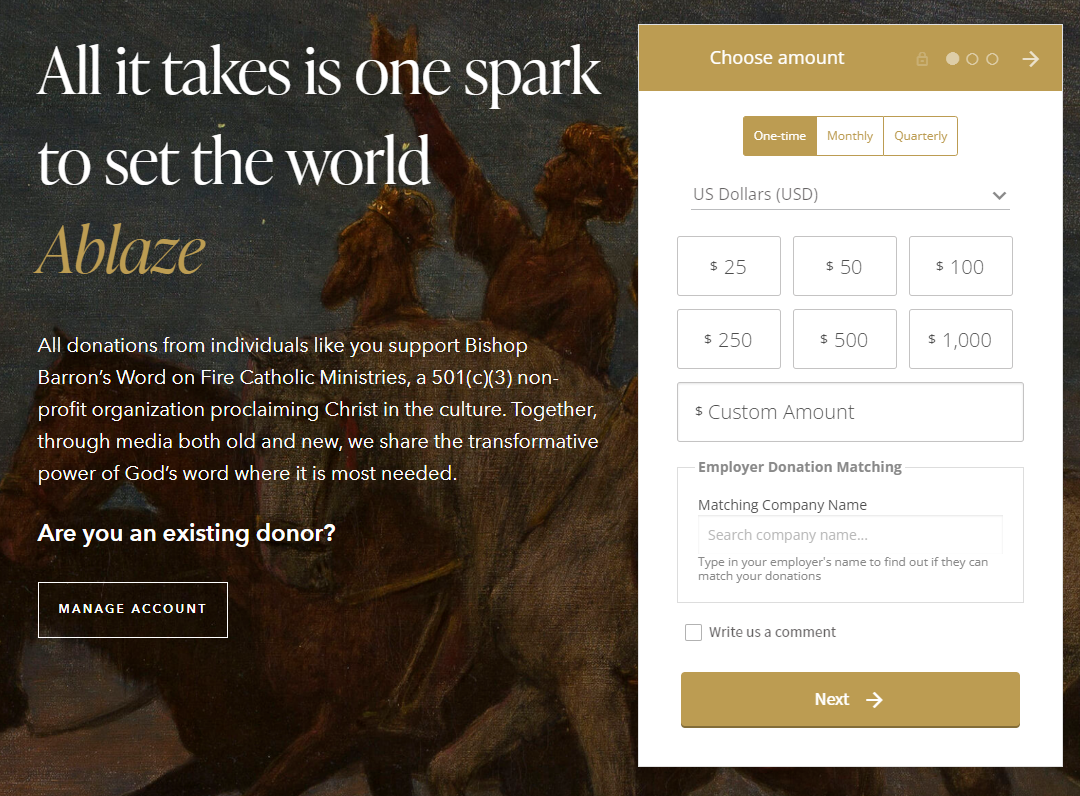

Donorbox allows donors to set up flexible recurring PayPal donations — these can be weekly, monthly, quarterly, or yearly.

PayPal allows donors to set up only monthly donations. For donors who want to give less often than this, the lack of flexible options can mean they only make a one-time donation.

For churches, weekly tithes can be set up as recurring donations. Your congregation can choose to repeat their donations on a specific day of the month. This makes it easier for people to give their tithes and can increase donations to your church. We’ve written a blog to give you a thorough insight into why PayPal is not the best option for churches and its alternatives. Read it here.

The donation form in the below image is a recurring one with monthly and quarterly intervals enabled in addition to one-time donations as per the nonprofit’s research and strategy. You may want to add weekly and annually, too, if that suits your nonprofit needs. This flexibility is what makes the difference.

Create a Recurring Donation Form

Yearly memorial funds are another option for recurring giving. Your donors can make regular tribute donations in memory of a loved one. This can be enabled on your Donorbox donation form.

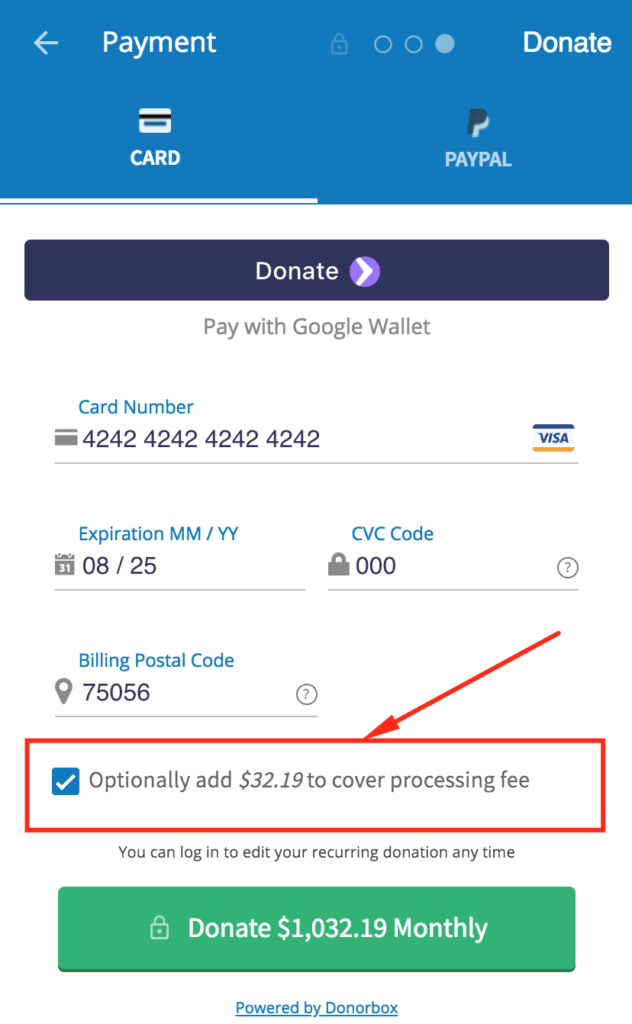

While the number varies with the platform, the latest stats indicate that more than half of your donors will cover the processing fees when given the option. Because that means they can help you do more good by giving a little extra than they were going to. Not a lot of difference. But for you, it indeed makes a big difference. This can help your organization save hundreds or even thousands of dollars in processing fees each month.

With Donorbox, you can ask donors if they’re happy to cover credit card processing fees to maximize their donations.

They can choose to cover the 1.99% + $0.45 processing fee for PayPal donations, and the 2.95% Donorbox platform fee, or 3.95% for Events, Peer-to-Peer, and Memberships. For Pro and Premium plans, the fee is even lower at 1.75% for features applicable at these levels, and only 2% for Events, Memberships, and Peer-to-Peer.

Bonus Resource: Learn more about nonprofit donation processing in this guide.

With Donorbox, donations are sent straight to your organization’s bank account. If you’re only using PayPal, your organization needs to transfer donations from your PayPal account to your bank account. Removing this step saves time and effort, and gives you quick access to your funds.

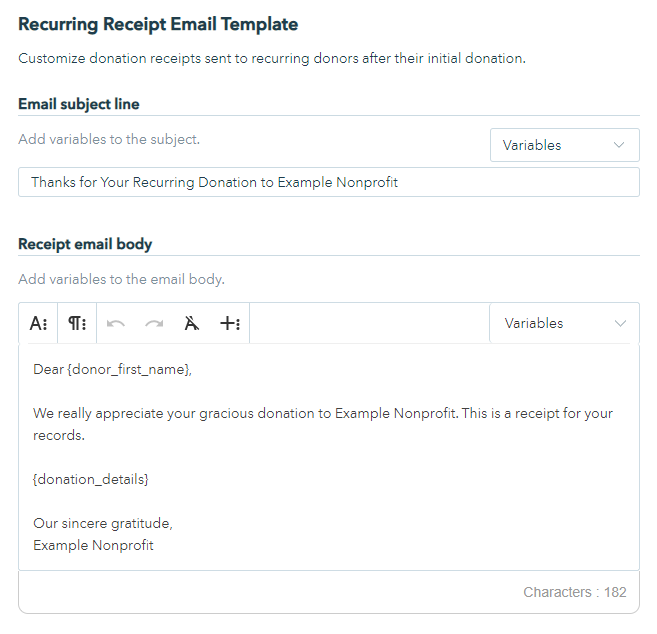

Your organization can send a customized thank-you receipt to your supporters after they’ve donated. The template, as shown in the image below, can be easily customized by your staff and updated at any point in the future to include more details. It is automated and is sent after every donation you receive. Sending customized receipts helps build stronger relationships with donors. It also helps your organization to be tax-compliant. But this isn’t possible if you only use PayPal.

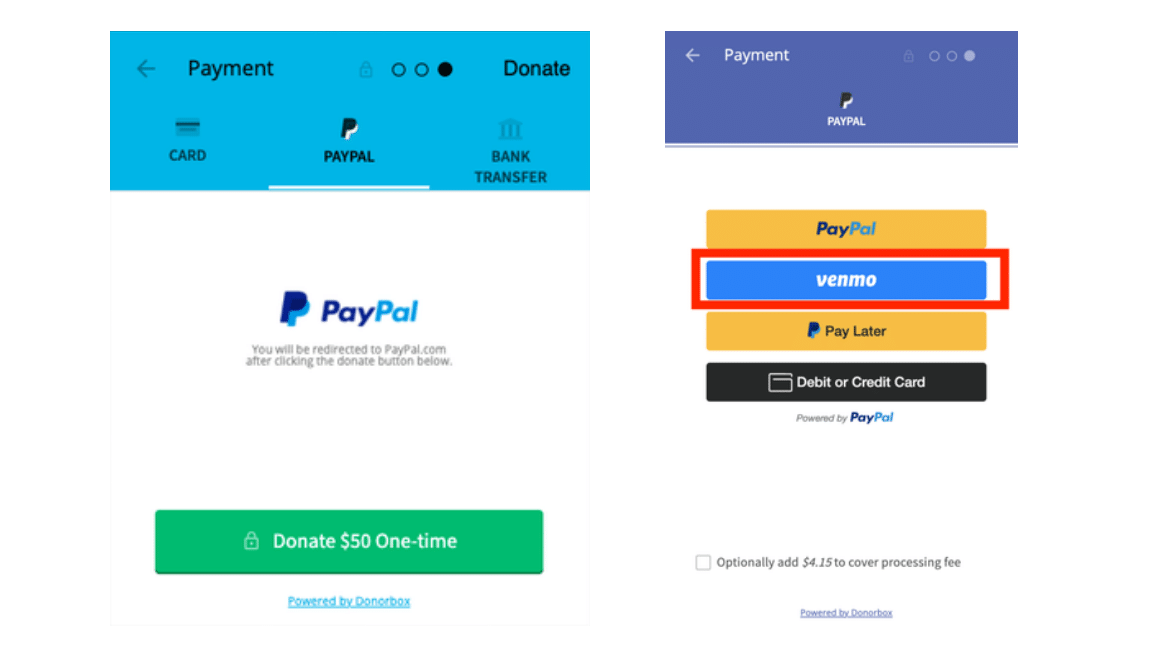

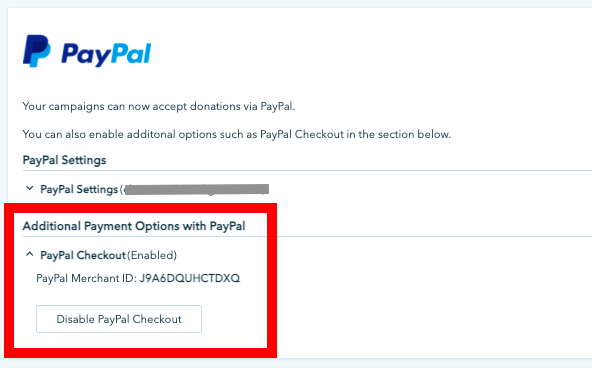

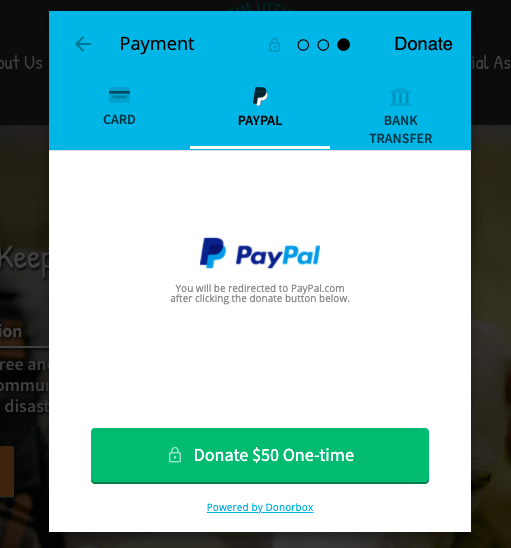

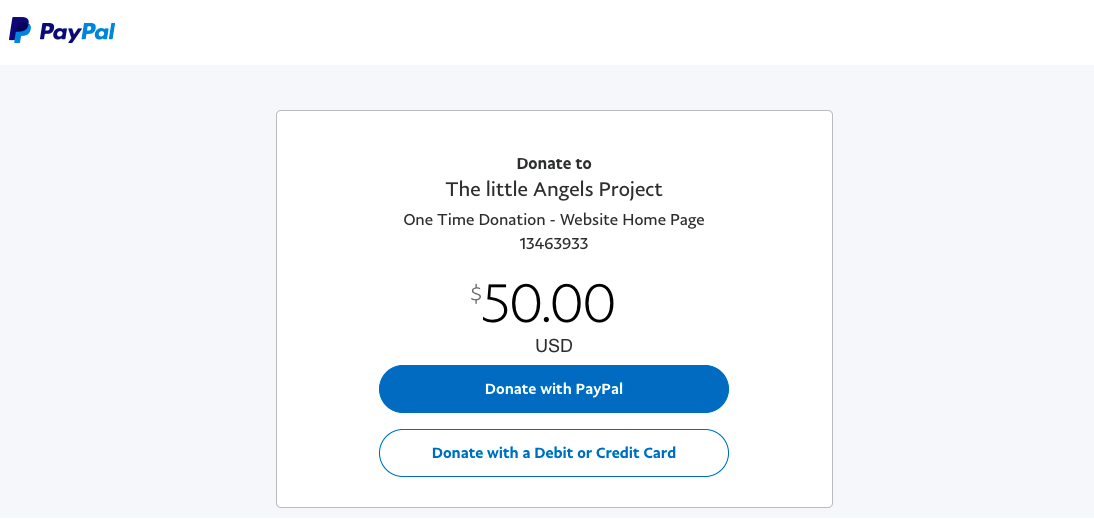

Donorbox connects with PayPal Checkout to give your donors a quick checkout experience.

It also integrates with PayPal One-Touch, allowing donors to stay logged into PayPal and move quickly through the checkout process. Here’s how –

Your donors can fill out the necessary information, select PayPal for payment, and click the ‘Donate’ button.

If they’re already logged into PayPal, the payment can be made with just one click, as shown below.

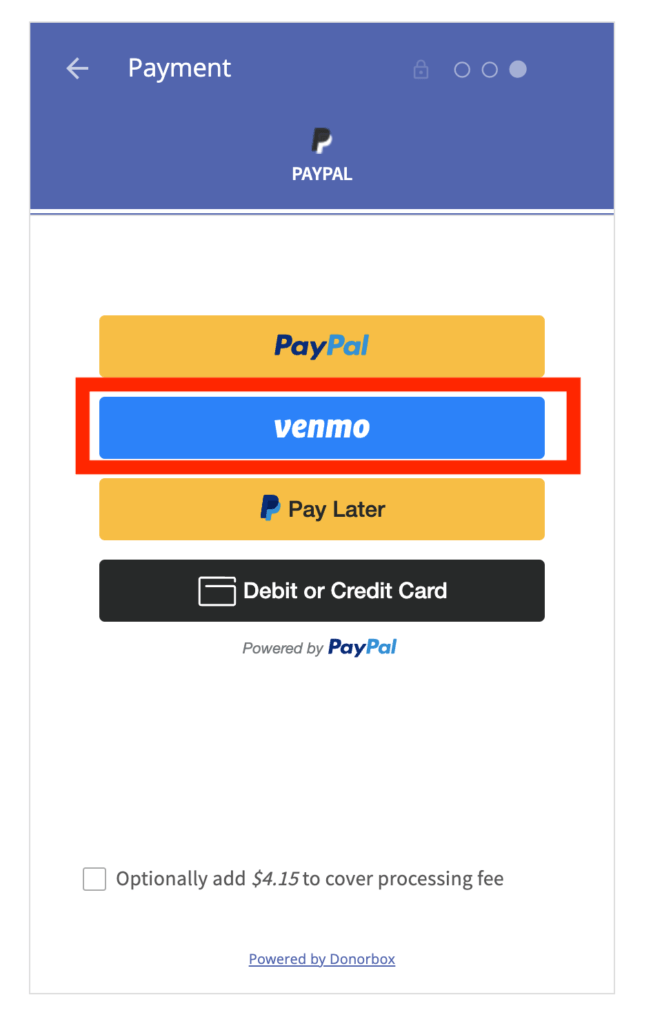

PayPal Checkout also allows your donors to use other quick payment options like Venmo. Donors can simply choose the option shown in the image below to make a quick donation to your nonprofit using their Venmo digital wallet. Even donors using the desktop can use this option to donate. They’ll be shown a QR code that they can scan on their Venmo app to complete the payment.

With Donorbox, you don’t just get a simple and fast checkout process but also a plethora of fundraising and donor management features and multiple payment methods (other than PayPal). Getting started requires 4 simple steps – signing up for free, creating a donation form, connecting with your payment processor, and going live!

Let us have a look at Donorbox’s customizable features, payment options, add-ons, and more –

These features aren’t available if you’re only using PayPal.

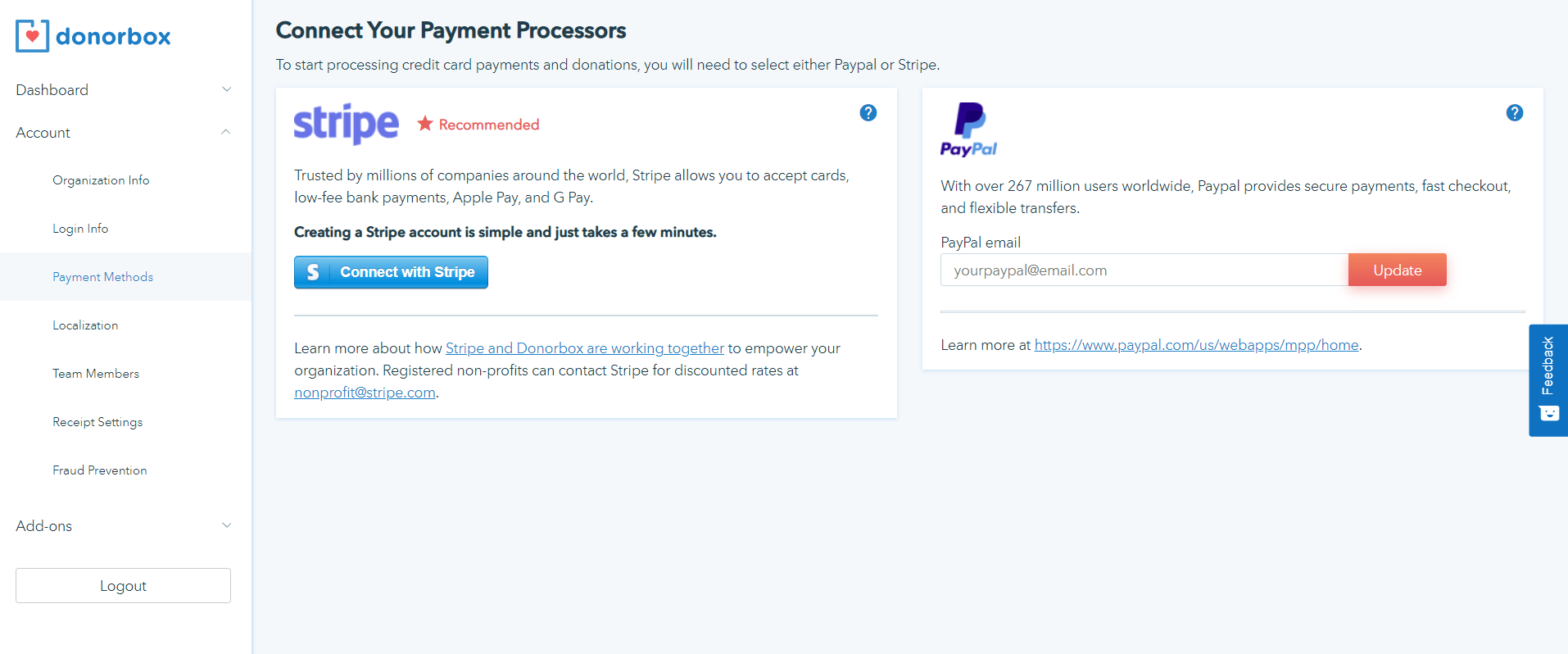

It’s easy to accept PayPal donations on Donorbox — we’ll walk you through it here.

Once you’ve logged into your Donorbox account, head into your “Account”, and click Payment Methods.

Add your organization’s PayPal account email and click “Connect”.

You’ll be taken to PayPal where you’ll enter your account email again, country/region, and login credentials. All that’s left is to click “Agree and Connect” to authorize PayPal to connect with Donorbox.

That’s it! You can now accept PayPal donations.

Note: Donorbox automatically upgrades all their new PayPal users to PayPal Checkout unless they’ve failed to complete the signup process or their country doesn’t support it.

You must have a PayPal business account to connect your PayPal with Donorbox. To start a PayPal business account, you must provide your legal name, email address, password, tax ID or social security number, business description, and business bank account details.

Yes, they do offer discounted rates for nonprofits. It is 1.99% + $0.45 per transaction with no monthly fees.

To avoid PayPal fees, you can sign up on Donorbox, which has an affordable platform fee of 2.95% for features included in our Standard plan, and 3.95% for Events, Memberships, and Peer-to-Peer at this level (which can be even lower if you opt for our Pro or Premium plans). Donorbox also gives you the option to let your donors cover the processing fees. Learn more about Donorbox’s plans and pricing here.

No. You can’t cover processing fees if you use PayPal for the donation system. But if you use Donorbox, you can always ask your donors to cover your processing fees.

You don’t get year-end tax receipts with PayPal. With Donorbox, you can get one-off & recurring donation receipts as well as year-end receipts.

Donations on PayPal are one-time and monthly. With Donorbox, nonprofits can accept one-time, weekly, monthly, quarterly, and annual recurring donations.

If your organization is eligible for the lower PayPal nonprofit fees, a fee of 1.99% + $0.45 per transaction will apply to donations. If you’re not eligible for this, the standard processing fee of 2.89% + $0.45 per transaction applies.

With Donorbox, you can ask your donors to cover PayPal processing fees and maximize donations. We have helped 100,000+ nonprofits across the globe make a greater impact through online fundraising and efficient donor management. Our features are easy to activate and simple to use, so you can focus on your mission and keep the good work going.

Take a look at our nonprofit blog for more tips on maximizing donations and creating better relationships with donors.

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.