How to Create a 501(c)(3) Tax-Compliant Donation Receipt

The holiday giving season, the most significant part of the year for nonprofit fundraising, is now behind us.

Many donors choose ...

Receiving a timely, visually appealing, heartfelt thank-you message can go a long way toward connecting supporters to your cause. It also helps make tax season easy for your donors!

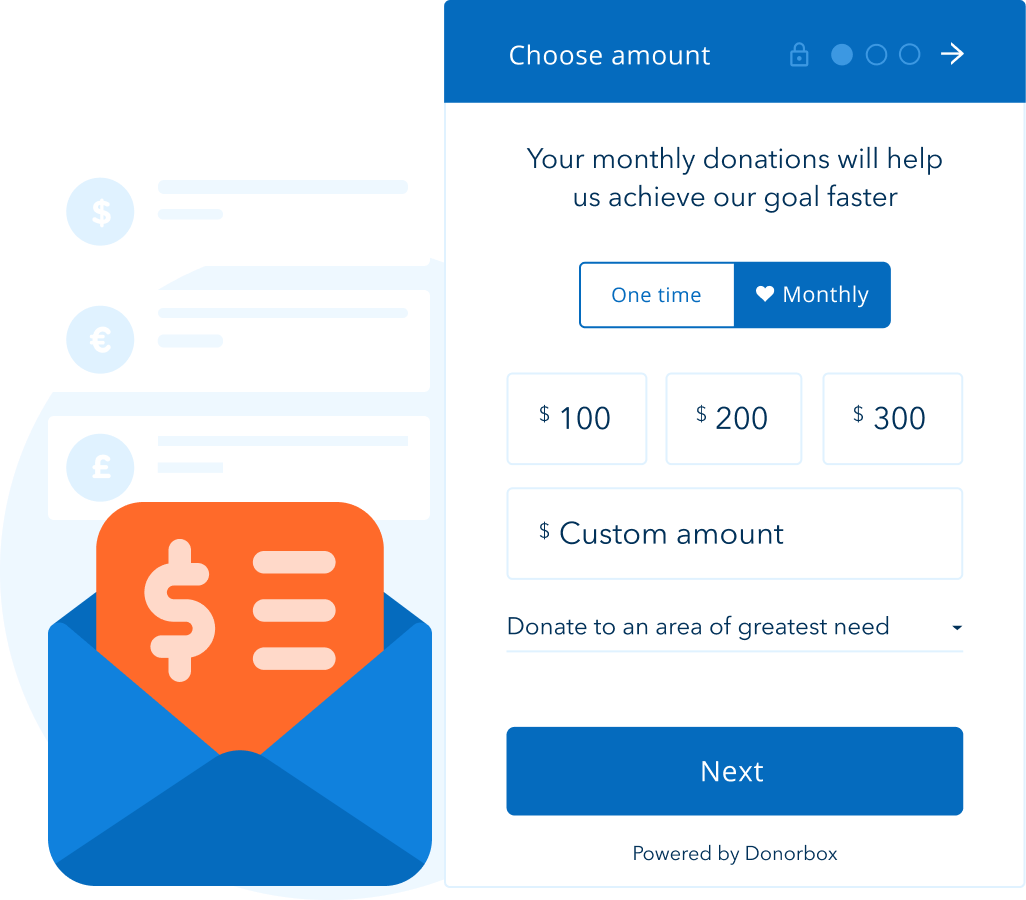

Donorbox automatically sends your donors a receipt for each gift they make.

A donation receipt expresses your organization’s gratitude for their generosity and fosters a strong relationship with donors!

Easily provide your donors with the written documentation they need for their tax-filing, and instantly assure them that their gift was received - no mail merge required!

Take your donation receipts to the next level by customizing them!

Add a header image to your donation receipts, helping maintain your organization branding and recall value.

You can customize the donation receipt and set up a variety of data fields

The end result? Your donation receipt will satisfy legal requirements while also leaving a positive impression with supporters.

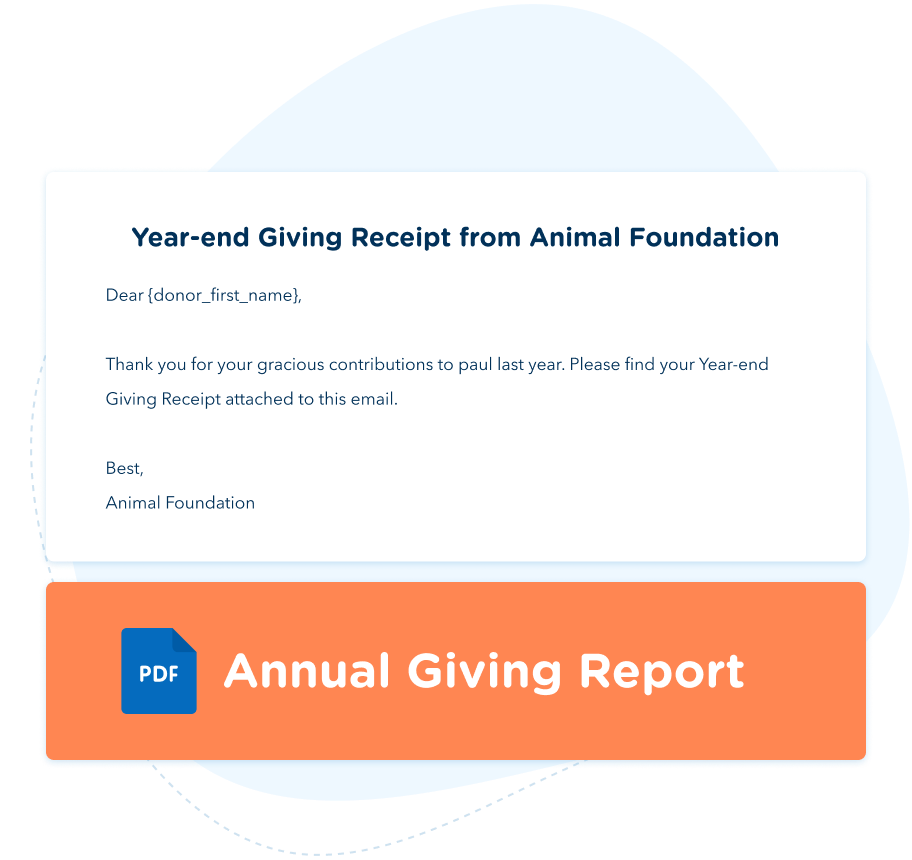

Save your donors from chasing down their past receipts. Instead, send them a convenient yearly summary of their giving.

Often, donors request a donation receipt at year-end for tax-filing. Make their tax season easy while giving a positive experience with your organization.

Send annual donation receipts individually to donors as requested. Or, send them to a group of donors - or even all your donors at once!

Did you know the IRS requires your 501(3) to issue a receipt for some donations?

Donorbox has you covered with automatic receipts that you can set up to satisfy legal requirements.

Plus, you’ll get peace of mind from built-in security features like fraud detection and donation form encryption.

Learn more about tax-compliant receipts on our blog.

Yes! The Donorbox Receipt template is completely customizable to include any necessary info.

Yes! Every donor automatically receives an emailed tax receipt for each donation they make.

Yes! Donorbox allows you to easily send year-end tax receipts to all your donors. This receipt will include the details of each donation the donor made during that year. Perfect for tax season!

Sending your donors a quick, on-brand donation receipt can help your donors feel appreciated as well as confident that their gift was processed. And, in some locations, depending on the situation, it may be legally required!

Don’t risk making donors feel unappreciated or falling out of legal compliance. With Donorbox, your supporters will automatically receive an emailed receipt each time they make a gift - no stamps or administrative time required!

In short: a lot! All Donorbox clients get access to tools for crowdfunding campaigns, text-to-give programs, and collecting recurring gifts. Plus, create unlimited customized donation forms, log donor interactions and milestones, and more!

Click on the logo to see how our fundraising software integrates

The holiday giving season, the most significant part of the year for nonprofit fundraising, is now behind us.

Many donors choose ...

In a world where nonprofit professionals face multiple competing demands on their time and are often under a lot of pressure, it can be easy to think nonprofit donation...

Donorbox makes it easy for donors to contribute, so we’ve also made it easy for your organization to say thank you.

Sending out year-end receipts is a great ...

There are a strict set of rules regarding donation receipts set by the Canada Revenue Agency (CRA) that Canadian.