As millions of people get checks from the government, many may have a few extra dollars they can give to their favorite nonprofit. As organizations send out appeals for donations, it is important to be prepared for the coming online donations.

The number of donors who give online grows every year. According to the latest stats on online giving, millennials prefer to give online and they make up to 5-10% of all donors for a nonprofit. Moreover, 40% of them prefer monthly recurring donation options (deducted from their online bank account). In general, online giving has grown by 12.1% since last year. The average online donation from mobile devices is $79 and that from desktop devices is $118. These numbers are a clear indication of how fast online fundraising has grown over the past few years. Even the older generations, having gone through the past couple of years of everything virtual, are now comfortable with online payment methods.

If your nonprofit wants to be part of this growing field of fundraising, a donation processing service is necessary. As a fundraiser, you will want to know the ins and outs of how these services work and which processing service will work best for you.

What is Nonprofit Donation Processing?

Nonprofits raise funds through several different avenues. Collecting one-time and recurring donations, crowdfunding, peer-to-peer fundraising, membership fees, event tickets, and selling products can all improve an organization’s bottom line. These fundraising types have their own tax rules and impacts on a nonprofit, but they can all be accepted with donation processing systems.

9 Important Donation Payment Processing Terms

Nonprofits are cautious when purchasing new fundraising tools and tend to look for systems that cost less. It is crucial to understand how a payment processing system works before deciding which one will work best for your organization. Below are a few terms that explain how these systems work and how they can impact your organization.

1. Merchant account

A merchant account is a nonprofit bank account set up to receive online donations. Check with your bank to understand the process and fees included.

2. Card association

A card association is a powerful group of banks like Visa, Mastercard, American Express, and Discover that sets the terms of all credit card transactions.

3. ACH debit payments

ACH stands for Automated Clearing House payments. Unlike credit card payments, these donations go directly from bank to bank. These payments are known as e-checks and can be completed in 72 hours. They are also an excellent option for recurring donors or larger donors.

4. Third-party processor

Third-party processors are software used by nonprofits to send payment requests. Some of the best-known processors are PayPal, Stripe, and Square.

4. Payment gateway

A payment gateway is fraud prevention used by payment processors for online donations. Some donation processing services have their own payment gateway systems. Others use a third-party one. Payment gateways encrypt credit card information and help reassure donors that their donations are safe.

5. Aggregator

Aggregators are large payment processors that support smaller businesses and nonprofits. PayPal is well-known and well-used by many small nonprofits.

6. Payment-enabled software

A payment-enabled software can send requests for donations through its own payment processor to the card association.

7. Virtual Private Network (VPN)

Virtual Private Networks or VPNs use data encryption to secure information and stop fraudulent payments.

8. PCI compliance

The Payment Card Industry (PCI) Security Council set up some security standards in 2007 to protect both the customer and the merchant involved in the payment transaction. Nonprofits should not violate these standards to avoid being suspended and facing penalties. Choosing a PCI-compliant payment processor is essential.

9. Tokenization and encryption

Tokenization is a mandatory requirement by PCI compliance standards. It takes sensitive information such as donors’ card details to replace them with a string of alphanumeric symbols as a part of its security measure. Payment processors create and issue these tokens themselves and therefore, it is upon them to keep the information safe.

Encryption is another important security measure for payment processors to help convert sensitive information from plaintext to cyphertext. The cyphertext, in turn, can be read with a key that is unique. It is used to keep donor data private and secure.

How Does Nonprofit Donation Processing Work?

Donation processing can happen quickly. This swiftness can surprise many people since there are quite a few steps to the online donation process.

- An online donation is made with a credit or debit card or an e-check.

- The donation goes through the payment processor payment gateway and is checked for potential fraud.

- If the donation is by credit or debit card, your payment processor will contact the card association (MC, VISA, AMEX, Discover), and they will send the donor information to the donor’s bank.

- The donor’s bank will see if there are enough funds to cover the donation.

- The donor’s bank will send an acceptance or denial to the card association and then the nonprofit.

- If approved, the donation is taken from the donor’s account and deposited into the nonprofit merchant account.

- The donor information the donor entered while making the donation goes into the nonprofit’s donor database.

Credit and debit card transactions will include a flat rate and a small percentage to cover processing fees. ACH payments are simpler since the process does not include the large card association. But these days, what works the best with your millennial and other newer generations of donors is the digital wallet payment option.

Donorbox offers a no-contract, low-cost donation processing option for all nonprofits. It uses Stripe as its main payment processing system and offers a plethora of payment methods including all kinds of credit and debit cards, low-cost ACH bank transfer, SEPA, Canadian PADs, UK Direct Debit, Apple Pay, and Google Pay.

All Donorbox campaigns come enabled with Donorbox UltraSwift™ Pay which helps you use the power of digital wallets like Apple Pay, Google Pay, Venmo, etc. They make the donation process 4 times faster for your donors.

Why Do Nonprofits Need a Payment Processor?

The answer to this question may seem obvious since a payment processor is necessary to accept online donations. Even with the rapid growth of online donations, some smaller nonprofits do not see the need for a payment processor. There are many ways a payment processor can increase funds for a nonprofit and help with donor outreach.

1. Donations

Nonprofits need a payment processor to accept online donations. Smaller nonprofits may opt to skip this because of cost, but there are payment processors that will not cost your organization an arm and a leg. A payment processor that also doubles as an online giving tool will help you in many ways – to help boost donations with features like crowdfunding, text-to-give, peer-to-peer fundraising campaigns, and store your donor information in its donor database.

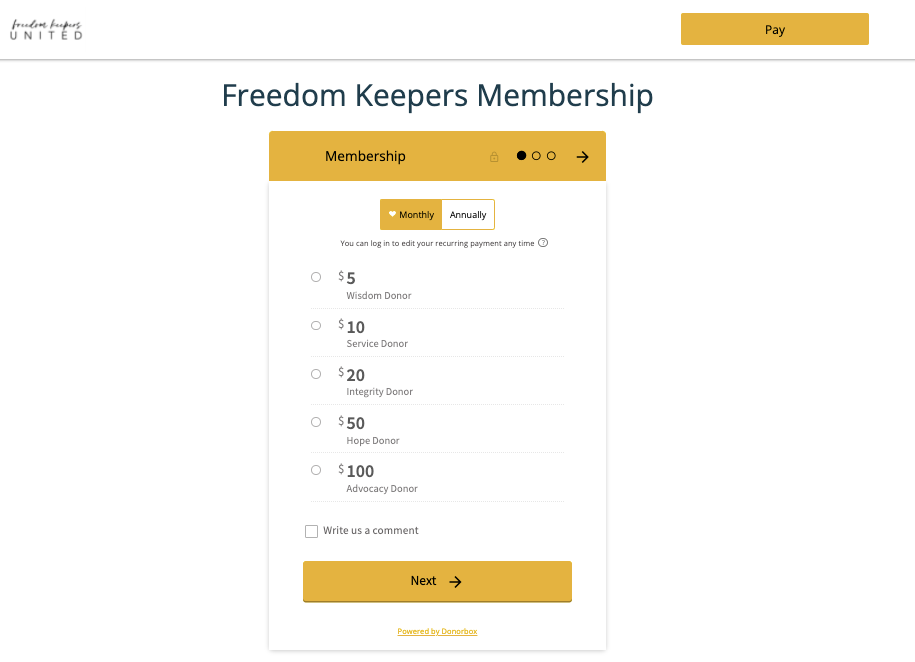

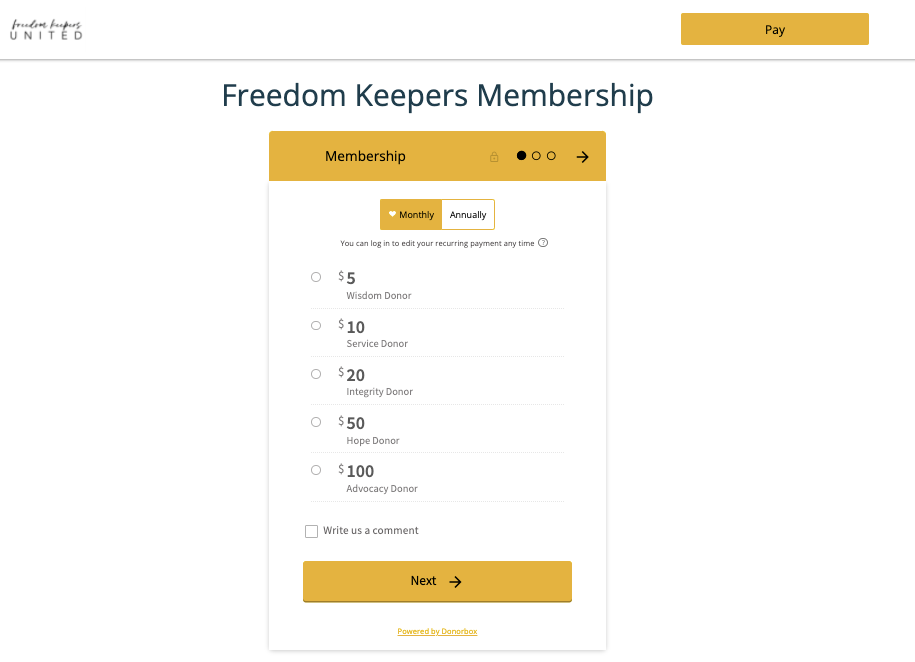

2. Membership fees

Many small nonprofit organizations rely on membership fees to continue their work. Convenience is essential in collecting these fees. If your organization has an online payment processor, you can collect recurring fees with a few extra steps. Donorbox lets you create simple membership campaigns, add unlimited membership tiers to them, manage your members and membership payments data at the backend, and highly benefit from a loyal supporters base through monthly and annual memberships. All this while helping you process the membership fees with utmost ease, maximum security, and high-end fraud-protection measures. Check this example below.

3. Online merchandise

Many nonprofits have begun selling products to raise more funds. Selling these products online can reach larger audiences and bring in a larger amount to your budget. Payment processors will help nonprofits sell these products and accept payments in the most secure way possible.

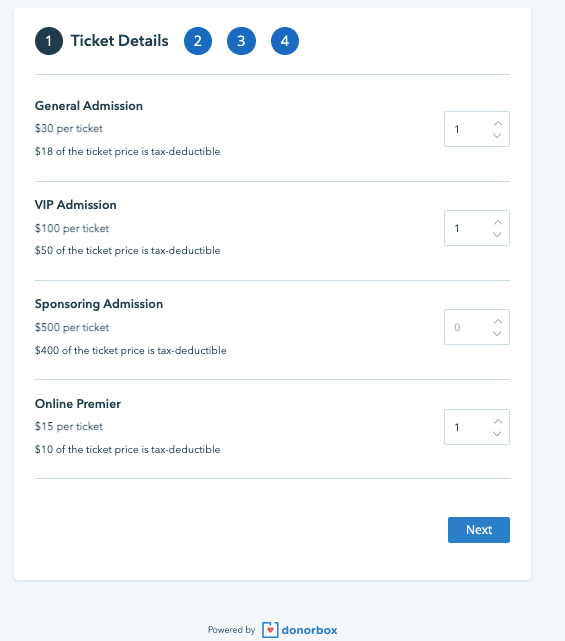

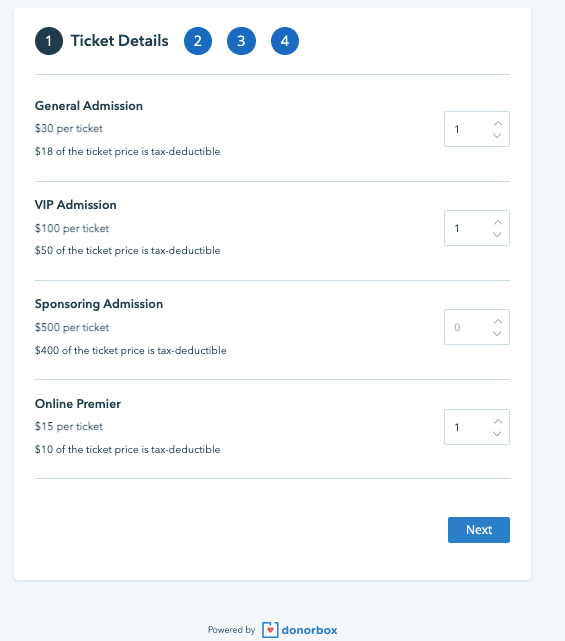

4. Event tickets

Almost all nonprofit organizations hold fundraising events to raise funds. One of the most frustrating parts of having events is selling enough tickets. Selling online tickets can limit some of this frustration. Payment Processors can make this process easy and safe. Donorbox lets nonprofits create a simple-to-use event page, add unlimited ticket levels, input fair-market value and tax rate to determine tax-deductibility of these tickets, manage ticket sale and purchasers’ information at the backend, and also accept donations from the event page. As usual, while also ensuring the utmost security of payment processing. Know more about Donorbox Events here. Check out this example of a Donorbox ticketing form here.

3 Types of Payments Nonprofits Should Accept

There are a few different ways your donors will give online. As a nonprofit, you will need a processing system that can accept each type of payment.

1. Credit/debit card payments

Donating by credit or debit card is easy and convenient. Most payment processors will accept credit and debit card payments from Mastercard, Visa, American Express, and Discover. There are two separate fees for this type of payment. Any credit or debit card payment will include a flat processing fee. There is also a percentage fee for credit card processing.

2. ACH payments and direct debit bank payments

Automated Clearing House payments, or ACH, are payments that move from one bank to another. This type of donation only includes the flat processing fee.

Donors generally type their bank account and routing numbers into an online form, and that donation will be moved automatically. With Donorbox ACH Payments, donors do not have to type in their account numbers. Instead, they choose their bank and use the username and password they have with their bank.

With direct debit payments (e.g. UK Direct Debit and Canadian PADs), your donors will authorize your nonprofit to debit money directly from their bank account, either one-time or on a recurring basis. This is done through a “mandate-email” process. With Donorbox, most of the steps are automated and you only click a few checkboxes//buttons to enable direct debit payments.

3. Digital wallet payments

Digital wallets are highly popular among the younger generations. Going by the latest studies, 1.31 billion people will use a mobile payment system for their cashless transactions by 2023, and Apple Pay transaction values would grow up to $1.5 trillion by 2024. Therefore, if your nonprofit is not providing options such as Apple Pay, Google Pay, Venmo, etc., you’re simply missing out on a large chunk of donations. Use Donorbox UltraSwift™Pay to leverage the power of digital payment methods and a simple-to-use & fast donation platform, all in one place.

Payment Aggregators

Payment aggregator is a name for a few large processing systems that help small businesses and nonprofits collect online payments. PayPal is the largest of these aggregators. PayPal does not use individuals’ bank accounts. Instead, they use their own merchant account to accept and send payments.

There is a percentage and flat fee for all payments processed. They do have a lower percentage fee for nonprofit organizations. The difference between PayPal and other payment processors is that a nonprofit cannot brand their donation pages if using PayPal.

This can be important because the average completed transactions on online donation pages increased by 50% since last year. If your customization and branding options are limited and you’re only focusing on using a tool to process payments, you have fewer chances of increasing donations. Your payment processor should adapt itself to emerging trends and let you optimize your donors’ experience for more effectiveness.

5 Key Features to Look for in a Nonprofit Payment Processor

If your organization is ready to accept online donations and is looking for the right payment processor, there are several different options. Below are a few different features you should research when making this decision.

1. Created for nonprofits

Payment processors created for nonprofits give organizations options others cannot. Features like recurring donations, company matching, donor management, text-to-give, membership campaigns, event-ticketing, crowdfunding, robust donation forms, goal meters, etc. can increase nonprofits’ incomes and encourage donor retention.

2. Flexible payment processing options

Not every online donor wants to give in the same way. Thanks to advances in technology, there are several ways to make a payment. This is especially helpful for organizations with donors from different countries. A payment processor that offers flexible payment options will make the donation process easier. All processors should accept credit cards, bank transfers, direct debits, digital wallet payments, and PayPal or payments from other aggregators.

3. Easy to set up

A new payment processing system can be frustrating if it is not easy to set up. Most nonprofits have limited time to spend learning new programs and do not have technical support. The best payment processing systems are easy to set up and work with your existing website.

4. Low processing costs

Like time, money is limited for most nonprofits. Cost is the first thing boards look at when approving budget increases.

Many payment-processing programs will include a sign-up fee, contract, and processing fees, including flat rates and percentage fees. When researching payment processing systems, find one that costs less but covers all your organization’s needs. Some payment processing programs also offer the chance for donors to pay processing fees when donating. This is a great way to decrease the cost of your payment processor.

5. Secure data processing

Hacking threats are real and prevalent in our society. Donors are aware of this and look for signs that their donation is safe. Ensure that your payment processor is PCI compliant and follows these 12 requirements:

- Install and maintain a firewall

- Does not use default passwords

- Protects cardholder data

- Encrypted cardholder data

- Uses and updates anti-virus software

- Maintains secure systems

- Restricts access to cardholder data

- Assigns a unique access ID to each user

- Restricts access to cardholder data

- Tracks all access to cardholder data

- Includes regular system testing

- Maintains a policy that addresses security

Frequently Asked Questions (FAQs)

1. Do nonprofits pay credit card fees?

Yes, each time a donor uses a credit or debit card to give online, there is a flat-rate processing fee and a percentage fee for credit cards. Nonprofits must pay this fee unless your payment processor offers donors the opportunity to pay these fees themselves.

2. How do nonprofits accept credit cards?

Organizations must have a payment processing system or an aggregator like PayPal to accept credit card donations.

3. How do nonprofits accept online donations?

Nonprofits can accept credit card payments, ACH payments, direct debits, and digital wallet payments from donors’ banks through their payment processors.

4. What are the best payment gateways for nonprofits?

A payment gateway is a secure pathway from your online donation form to the credit card processing company. Online donation systems require a payment gateway to protect donors’ credit card information. Many nonprofits work through their merchant account provider to set up a payment gateway. Others use third-party providers like Authorize.net.

Conclusion

When researching payment processors, nonprofits should find an all-in-one, affordable system that is secure and easy to set up. The system should be created for nonprofits and include features that encourage more donations.

Donorbox offers safe and affordable payment processing. No contracts or startup fees are needed. The platform fee starts at just 1.75% for the Standard plan, which can be further reduced to 1.5% for most features when you upgrade to our Pro or Premium plans. These plans are curated to meet all your fundraising needs while also helping you grow and scale your efforts.

Payment processing fees are also lower with Donorbox through PayPal, Stripe, and ACH payments. Plus, your donors get an option to cover these fees. Learn about Donorbox plans and pricing here.

Our system includes branding options, customizable donation pages, and features like donation thermometers, recurring donations, tribute donations, advanced fundraising options, and easy integration with your website. Learn more about Donorbox features here. Donorbox now offers Donorbox Premium to help you scale your fundraising further and realize your donation potential with an expert fundraising coach, dedicated account manager, tech wizards, and priority support.

Our nonprofit blog offers tips and tricks to help you with fundraising.