Planned Giving for Nonprofits: Ultimate Guide for 2025

Planned giving has been trending for years – and for good reason. Read on to learn how to add planned giving to your fundraising strategy.

Planned giving has been trending for years – and for good reason. Read on to learn how to add planned giving to your fundraising strategy.

Many nonprofits have added planned giving to their fundraising strategy. You may ask why and find it difficult to understand how waiting around for a gift could benefit your organization. But there are some facts that will blow your mind. In 2020, despite the onset of the pandemic, over $41 billion was given through planned giving. Another report shows that an average planned gift amount is almost 200 times a donor’s largest annual gift amount. These figures are self-explanatory as to why nonprofits these days choose to rely on these gifts alongside other donation methods.

This article will explain what planned giving entails, why it’s important, and how to include it in your fundraising plans.

Planned giving is also known as legacy giving or legacy gift planning, and these gifts are major gifts for a nonprofit organization. It is hugely driven by the donor’s intention to make a major gift to a charity, which otherwise might be difficult with their current income. Donors plan for these gifts as a part of their overall financial or estate planning. These may include life insurance, personal property, cash, real estate, donor’s retirement plan, and gifts of equity. Annual donations and membership payments are not a part of planned giving.

Many major donors are concerned about taxes limiting the amount they can leave to their heirs. Whereas nonprofits are increasingly looking for ways to encourage major donations. Creating a planned gift or legacy gift program gives both sides the chance to benefit from the gift.

There are several reasons why an individual will include a planned gift in their will. These reasons range from supporting an organization’s mission to tax breaks. Below is a list of why donors may want to leave a planned gift:

Nonprofits can benefit in many ways from a planned giving program. Here are a few reasons an organization will want to include it in their fundraising plans:

While most planned gifts do not benefit your nonprofit right away, some can. Regardless of the type of planned gift program, nonprofits must have a plan to receive the gift and use it to fulfill the organization’s mission.

Donors may want to give a nonprofit real estate to benefit from the large tax break they can receive. Nonprofits can either use the real estate for their own needs or sell it at fair market value. For this gift type, donors leave this gift in their estate plan, wanting to support an organization of their choice at some time in the future.

When receiving property through an estate plan, your organization must know about any liens, environmental hazards, other landowners, insurance requirements, and maintenance needed before accepting the donation.

A common way nonprofits receive revenue right away from a planned gift program is with a charitable lead trust. The charity gets payments from the trust during the donor’s lifetime and other non-charity individuals, most often the donor’s heirs, receive the remaining income at the end of the trust.

Appreciated securities are not cash gifts. These gifts are stocks and are an excellent way to get the largest tax break for a donation. The donor can claim the total amount the stock was sold for on their taxes even if they purchased it at a lower price.

When individuals reach 70 ½ years old, the IRS requires them to withdraw a certain percentage from their IRA (Individual Retirement Account) or 401K every year. Each withdrawal is taxed. In 2018, a new tax law was passed that allows people to give up to $15,000 as an individual or $30,000 as a couple without paying taxes. Owners of a retirement plan can either provide this amount to their heirs or a charity.

Bequests are the most popular type of planned gift. Donors leave a specified amount to a charity in their will, and charities will receive the full amount in the event of their death. It is not rare for nonprofits to be unaware of this gift until they’ve received one.

Life insurance is a must-have for your family, but something people may not think about is the tax-free cash payout when the owner dies. Most individuals purchase a life insurance policy for the sake of their family, but donors can also leave this policy or part of this policy to their favorite charity.

Split interest gifts, like a charitable remainder trust, can be complicated and require financial and legal professionals to help your organization and donor finalize the details. These gifts provide nonprofits a donation in the future and regular investment payments for the donor during their retirement. The benefit of this type of planned gift is obvious and provides a fantastic retirement income for the donor.

By creating a program that lays out ways donors can contribute significant amounts to your organization, you simplify the process. When promoting your planned giving or legacy gifts program, there are several steps your organization can take to encourage more donors to give.

Board members may be unaware of this donation opportunity and the tax breaks they can get in exchange for these donations. By informing them of the reasons and benefits that come from this type of gift, you may luck out and find a few board members interested in scheduling planned gifts for themselves. It is also the best way to get your board excited and willing to promote the program to the community. Many board members have connections with people who want to make this type of donation.

Pro tip: You should build a committee or advisory board of legal and financial experts willing to provide necessary information to your donors. Look for a financial advisor, attorney, and board member with previous experience with this type of donation. This committee will be in charge of developing a planned giving guide that includes in-depth information on the same.

Along with your planned giving guide, your nonprofit must have a case statement to hand out to individuals that may be interested. When creating a case statement, there are several things to include, but the most essential are your organization’s mission, vision, values, programs, financial status, impact on the community, and details about this giving program.

As we said earlier, there may be times when it is not in the best interest of your nonprofit to accept all planned gifts. In this case, you must have a policy in place that details how and when to deny these gifts. Keep your mission front of mind when creating these policies, so when specific gifts like property come up, you can make the right decision for your organization.

At first, your planned gift committee will want to keep these policies simple. As you receive more gifts and issues come up, you can add details more specific to your nonprofit.

Planned gifts or legacies are a wonderful opportunity for nonprofits to recognize donors. Individuals that support your organization and leave a significant donation in their will should be honored. Creating a society and donor wall to highlight these gifts is an excellent way to promote the program and thank those who have given.

The committee can work with your nonprofit’s development or fundraising department to create a brochure. This marketing piece should give a simple explanation of how donors can designate your nonprofit as a beneficiary in their will and why it benefits them and the organization.

Pro tip: Promote planned giving to all donors regardless of their annual income and make them aware of what it is. These gifts are one such section of major gifts that you get to acquire from all kinds of donors irrespective of their current wealth status.

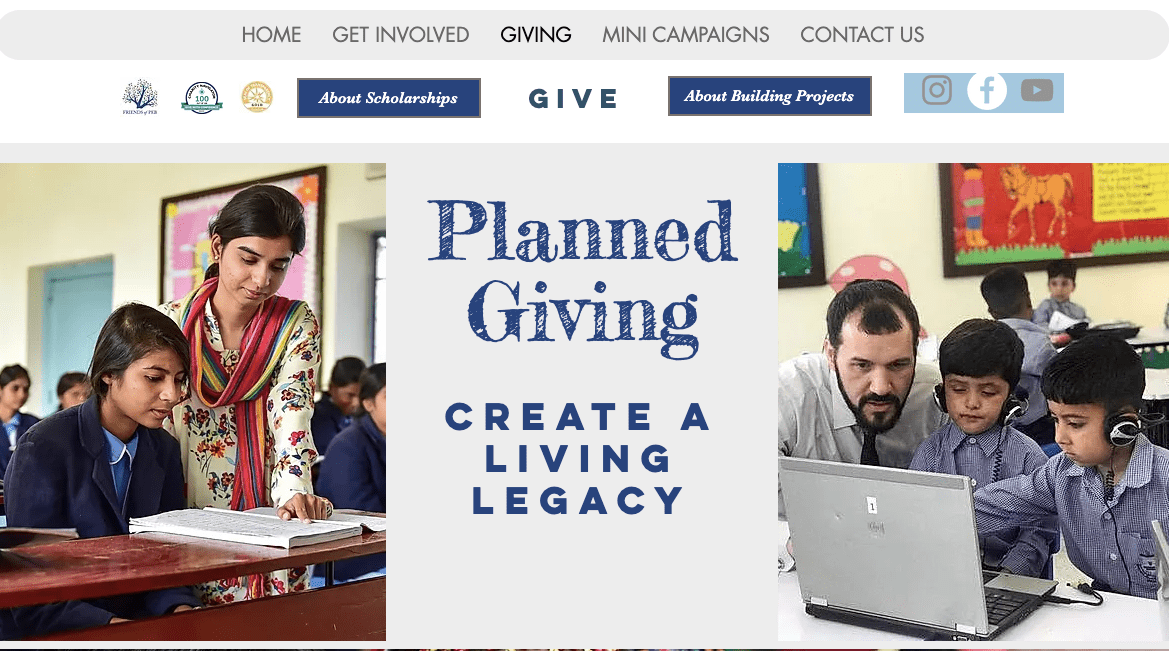

Marketing a planned giving program should not stop with a brochure. Adding your legacy society and information on this giving program to your website makes it easy for donors to learn more. You should check out the below planned giving page on Friends of PEB’s website for an excellent reference.

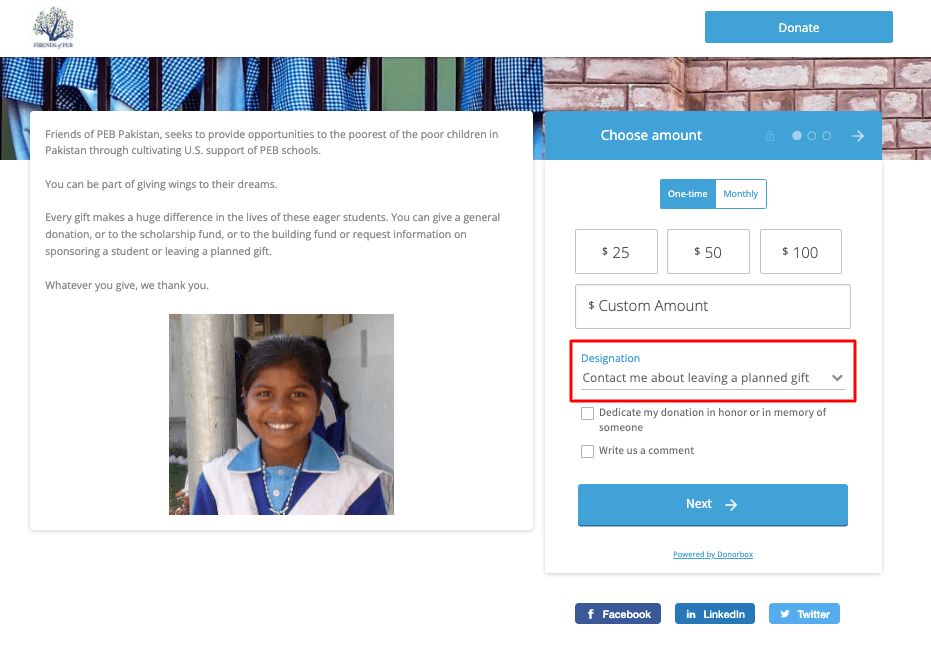

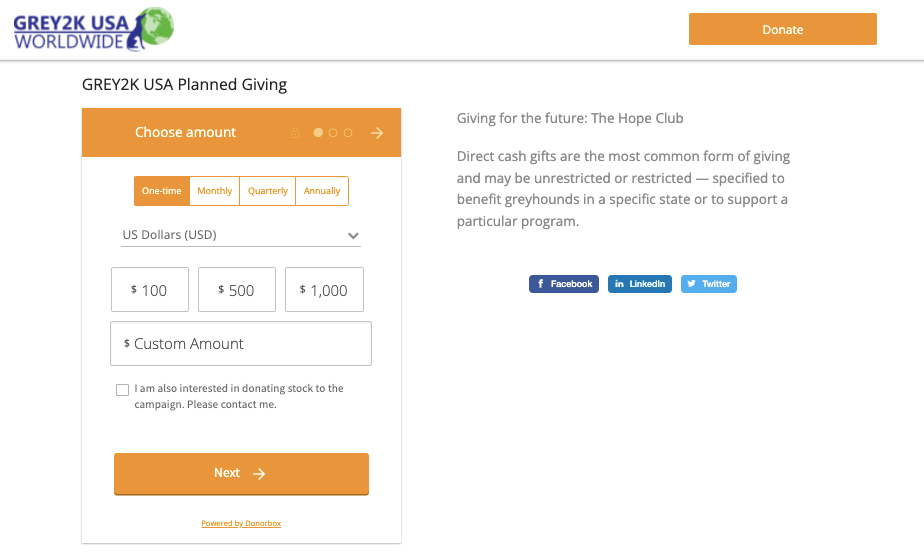

Since planned giving is not an immediate concern for most, it is crucial that your nonprofit reminds donors of such opportunities whenever possible. An easy way to do this is by adding a link to your online donation form or a check box on all gift acknowledgments for people to learn more. The below image shows a simple online donation page that lets donors select the option of being contacted for planned gifts right from the donation form.

A great way to subtly promote the program is to add a planned giving message to your email signature. Most donors will ignore the message, but you may find a few donors interested in learning more and even could end up with a gift. Add the link to your respective page on your website, maybe also a line about which different gifts you’re open to receiving.

An informational meeting is one of the best ways to educate your donors. Most of your donors do not have their own financial advisor and will appreciate the chance to learn more about planned giving and how it can benefit them, their families, and your nonprofit.

Pro tip: It is best to use experts that serve on your committee or ask outside professionals to lead the meeting. The focus should be on education, especially the fact that planned giving has nothing to do with their current wealth status and can, in fact, benefit them too.

Your nonprofits should have a planned giving campaign every year for the best donor response. These campaigns can cost next to nothing when done online, so you do not have to worry about tracking your return on investment right away. You can also add such giving options to other fundraising campaigns like your year-end holiday campaign.

The below campaign is simple and can work as a great reference for building your own planned giving campaign page. Apart from donations, they have also added a checkbox for donors who want to donate stock to the campaign. This way a nonprofit can encourage different options.

Pro tip: An excellent time for a planned giving campaign is when people have it on their minds during tax season. By bringing up the tax benefits for donors, you can entice supporters to learn more and potentially set up a planned gift this year with their accountant.

Bonus Resource: Watch this insightful webinar that will empower you to create effective planned giving programs:

Subscribe to our YouTube Channel to get trending fundraising strategies every week!

Planned giving should be an essential part of your fundraising strategy. Even if you do not see a return on your investment right away, you are investing in the future and attracting major gifts to your organization.

Donorbox helps you create intuitive and effective online campaigns for your nonprofit. It is an affordable online fundraising tool with advanced features like crowdfunding, peer-to-peer fundraising, text-to-give, membership campaigns, and more. Visit our website for more info.

Get fundraising tips, resources, and nonprofit management insights on our blog and sign up for our newsletter to fuel your fundraising efforts.

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.