If you’re a UK-based charity, you can enable Gift Aid to maximize your donations. This is a simple way to boost the donations you receive, with no extra effort on your part. You can easily enable Gift Aid through Donorbox—we’ll walk you through the steps later in this article.

Read on to understand what Gift Aid is, how it works, and more!

What is Gift Aid?

Gift Aid is an income tax relief designed to benefit charities and Community Amateur Sports Clubs (CASCs) in the UK. Gift Aid increases the value of your charity’s donations by 25%, because you can reclaim the basic rate of tax on your donations – at no extra cost to the donors.

You can claim back 25p every time an individual donates £1 to your charity or community amateur sports club (CASC).

This allows your nonprofit to boost eligible donations by 25%.

How Does Gift Aid Work?

To be able to claim Gift Aid, the organization must be recognized as a charity or CASC.

- Based in the UK, EU, Iceland, Liechtenstein or Norway

- Established for charitable purposes only

- Registered with the Charity Commission or another regulator, if this applies to you

- Run by ‘fit and proper persons’

- Recognized by HM Revenue and Customs (HMRC)

You can claim Gift Aid on donations from individuals. The donor must:

Your donors’ Gift Aid status can be saved, which enables you to reclaim extra tax every time they donate.

Special Rules Around Gift Aid

There are special Gift Aid rules relating to some fundraising activities, including:

1. Sponsored Challenges

Sponsored challenges are eligible for Gift Aid if all travel and accommodation costs are paid by the donor. This portion can’t be counted toward Gift Aid.

Sponsorship payments from a “connected person” are also ineligible for Gift Aid. This includes family members of participants and companies linked to donors.

Pro tip: Add a disclaimer to your marketing materials and sponsorship forms. This can explain that donations from a “connected person” aren’t eligible for Gift Aid. It also shows you’re not trying to claim Gift Aid on ineligible donations.

2. Membership fees

You can claim membership fees through Gift Aid. To do this, you cannot allow your members to use your services or facilities for personal use.

Because of this personal use rule, Community Amateur Sports Clubs (CASCs) can’t claim Gift Aid for membership fees.

3. Tickets for fundraising events

If you’re hosting a fundraising gala or another ticketed event, you may or may not be able to claim Gift Aid on payments. HMRC usually considers these funds raised to be profits and not donations. However, it depends on whether your donors need a ticket to attend your event.

If your supporters need to buy a ticket, you can’t claim Gift Aid. If they’re making voluntary donations to attend, these payments can be eligible for Gift Aid.

4. Volunteer expenses

If you reimburse your volunteers for expenses, this may be eligible for Gift Aid. Your volunteers can choose to give a payment back to you as Gift Aid. This can be the full reimbursement amount or part of it. For this to work, your volunteers need to have made a payment to your organization.

Are All Donations Eligible for Gift Aid?

Not all donations are eligible for Gift Aid. HMRC can remove Gift Aid from donations at a later date if the department decides they’re not eligible.

A few situations that may cause problems include:

1. Donors may not be eligible

Even if a donor has agreed for you to claim Gift Aid, HMRC can still remove it if they’re not eligible.

Donors need to have paid Income Tax or Capital Gains Tax that’s equal to the amount you’re trying to claim back. They need to have paid this in the relevant tax year.

2. Donors can’t donate on behalf of others

You can’t claim Gift Aid on donations made on behalf of other people.

Imagine this scenario: A friend gives £10 to one of your supporters and asks them to donate through their account. This donation isn’t eligible for Gift Aid because HMRC isn’t able to see the details of the true donor.

3. Other things you can’t claim Gift Aid on

A few other situations that you can’t claim Gift Aid for include:

- Donations made for goods or services

- Good or services that your organization has paid for

- Nonprofit greetings cards

How to Enable Gift Aid Contributions Through Donorbox

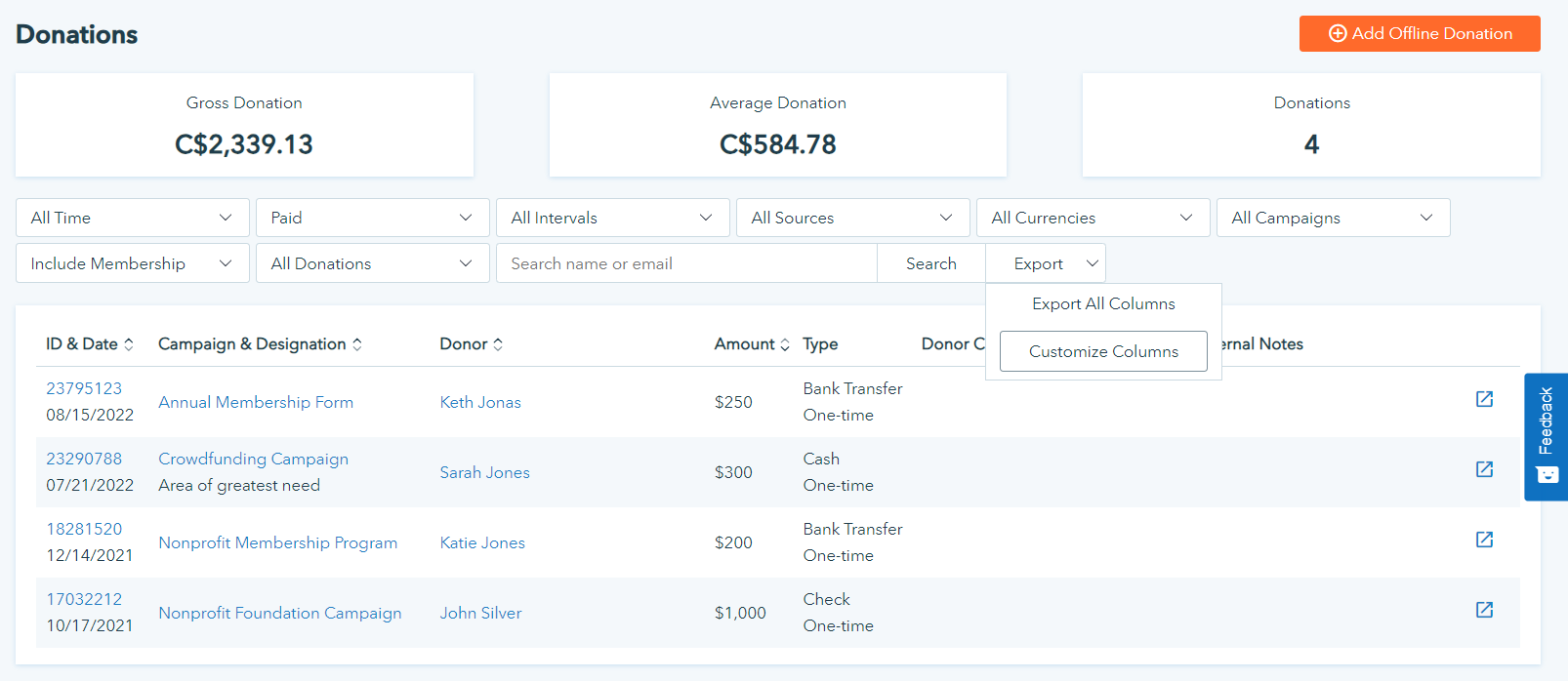

With Donorbox, your donors can easily mark their donation as a Gift Aid contribution.

Here’s how you can make it happen.

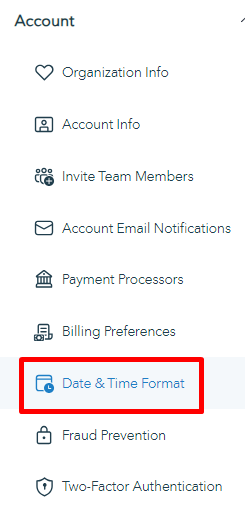

Step 1: Go to your Donorbox account

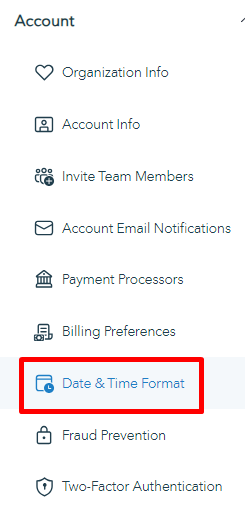

To enable Gift Aid, log in to Donorbox and go to the Account section.

Now, click on Date & Time Format for your localization settings.

Step 2: Check your localization settings

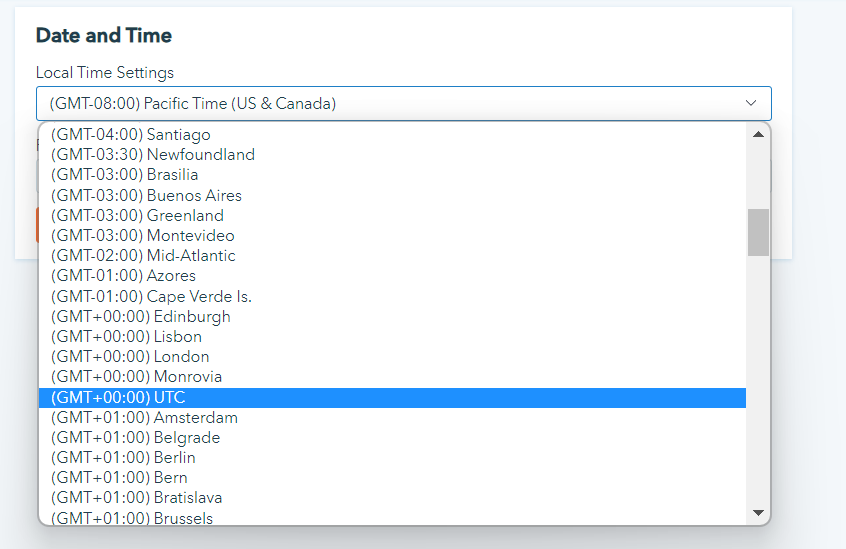

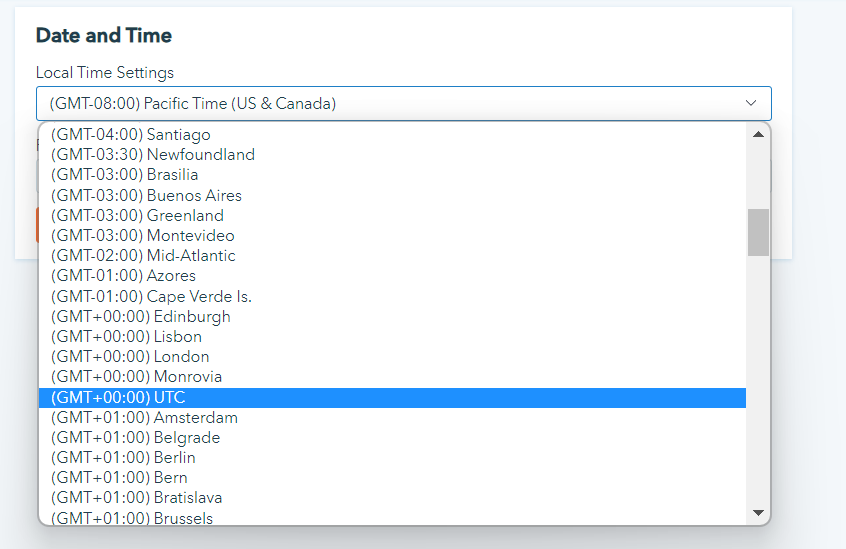

Make changes to your localization by clicking on the dropdown.

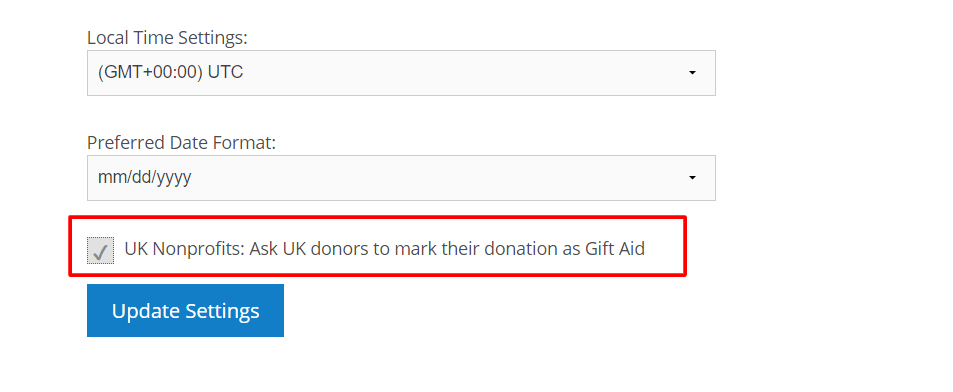

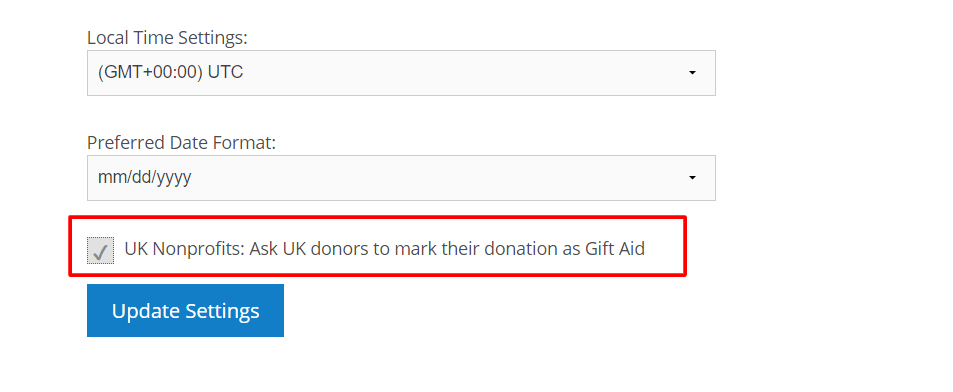

Step 3: Check to enable Gift Aid

You can now choose to enable Gift Aid for your UK donors by checking this option.

Step 4 – You’re done! Now, let donors allow you to claim Gift Aid!

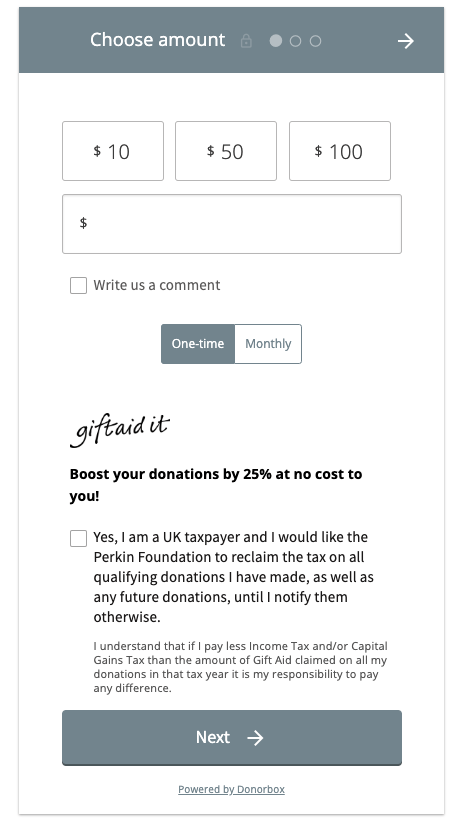

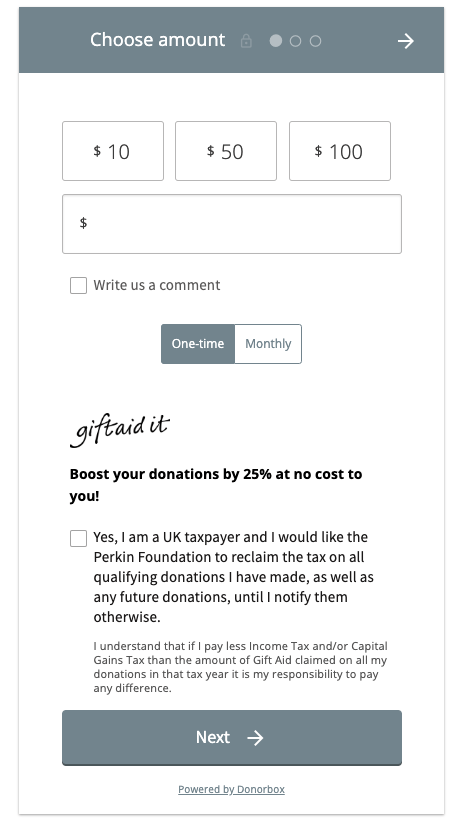

Once you’ve enabled Gift Aid, your UK donors can see the Gift Aid options on your Donorbox donation form.

Enable Gift Aid Contributions!

This can maximize your donations by 25% at no extra cost to your donors.

Step 5: Spread the word

Let your supporters know they can mark their donations with it. Spread the word on your blog and social media channels, and send emails to past and present donors. If your UK donors are aware they can easily help maximize donations for you, they’ll likely jump on board.

Pro tip: Use donor management software to segment your donors based on their location. This allows you to tell only your UK donors about Gift Aid. You can do this in Donorbox by asking donors for their location on your donation form. The Donorbox supporters database enables you to quickly apply filters to find out this information.

When to Claim Gift Aid

The deadline to claim depends on what you’re claiming on and how your charity is set up. You must keep records for 2 years after the deadline.

If the donor hasn’t made a declaration you may still be able to claim on cash donations of £20 or less, for example from a collection.

How to Claim Gift Aid

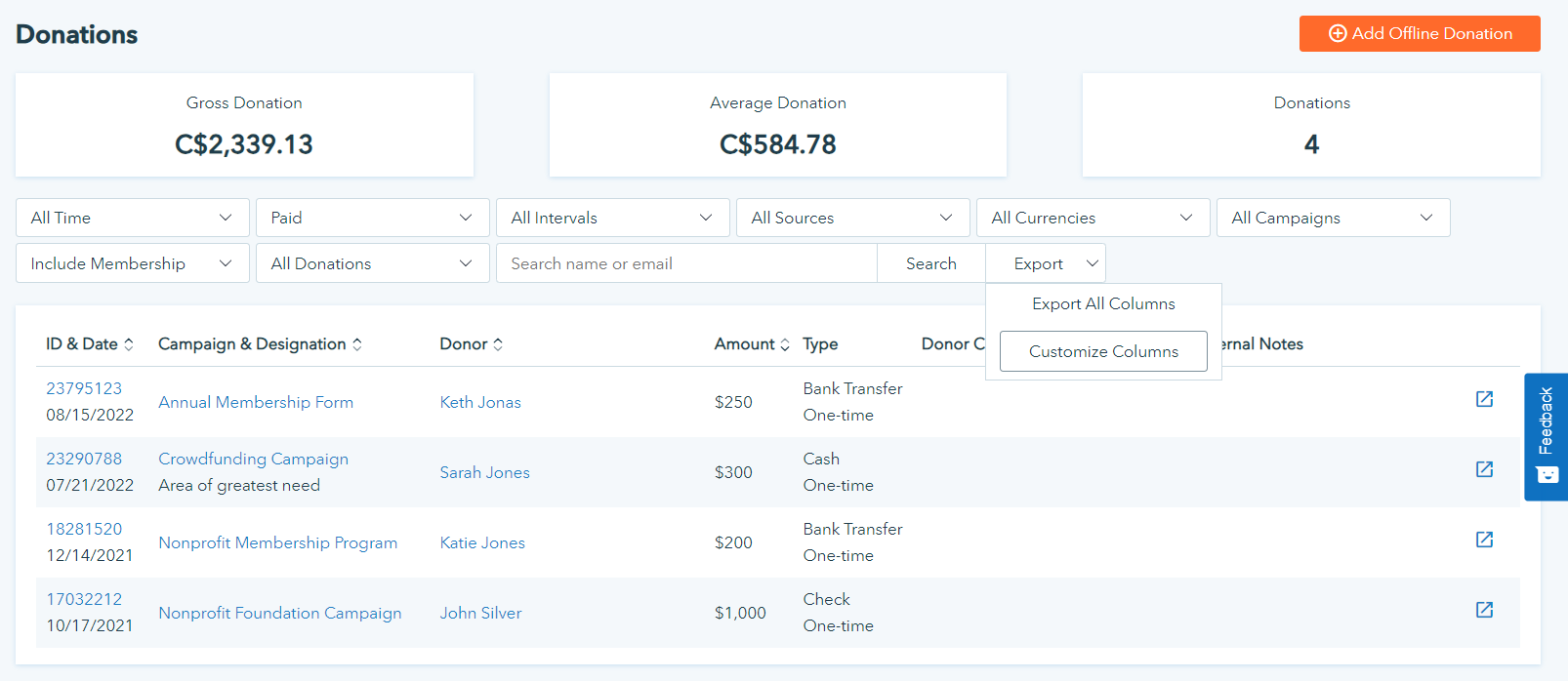

An organization can attach a ‘schedule spreadsheet’. It can claim for up to 1,000 donations on each spreadsheet.

You can also claim through eligible software, like a database. Use the Donorbox database to filter out donations made by the UK donors and export the data to create a schedule spreadsheet. Note that you must check with your financial advisor to ensure you’re including the necessary columns and data in the exported spreadsheet.

Sign Up for Donorbox

Click here for detailed steps on claiming Gift Aid online.

Note: Donorbox does not submit the claim on behalf of the organization.

When will You Get Paid?

You’ll get your Gift Aid payment by BACS within:

- 4 weeks if you claimed online

- 5 weeks if you claimed by post using form ChR1

UK Organizations Using Gift Aid

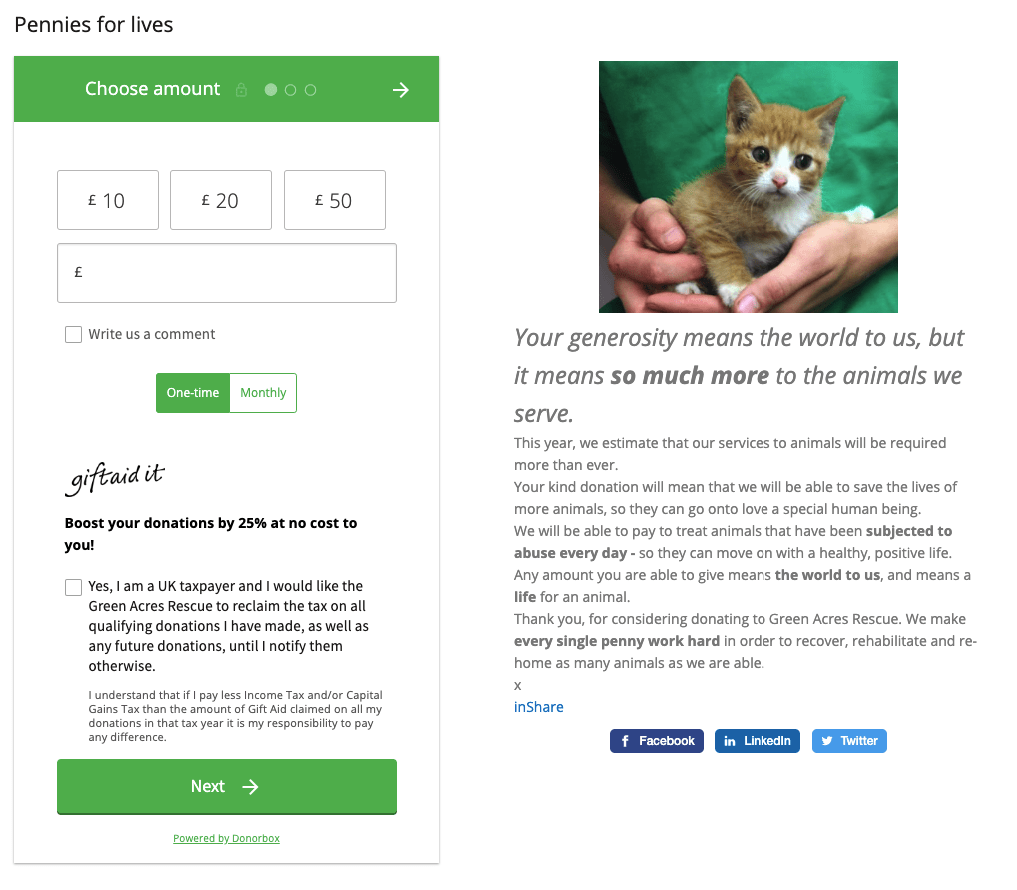

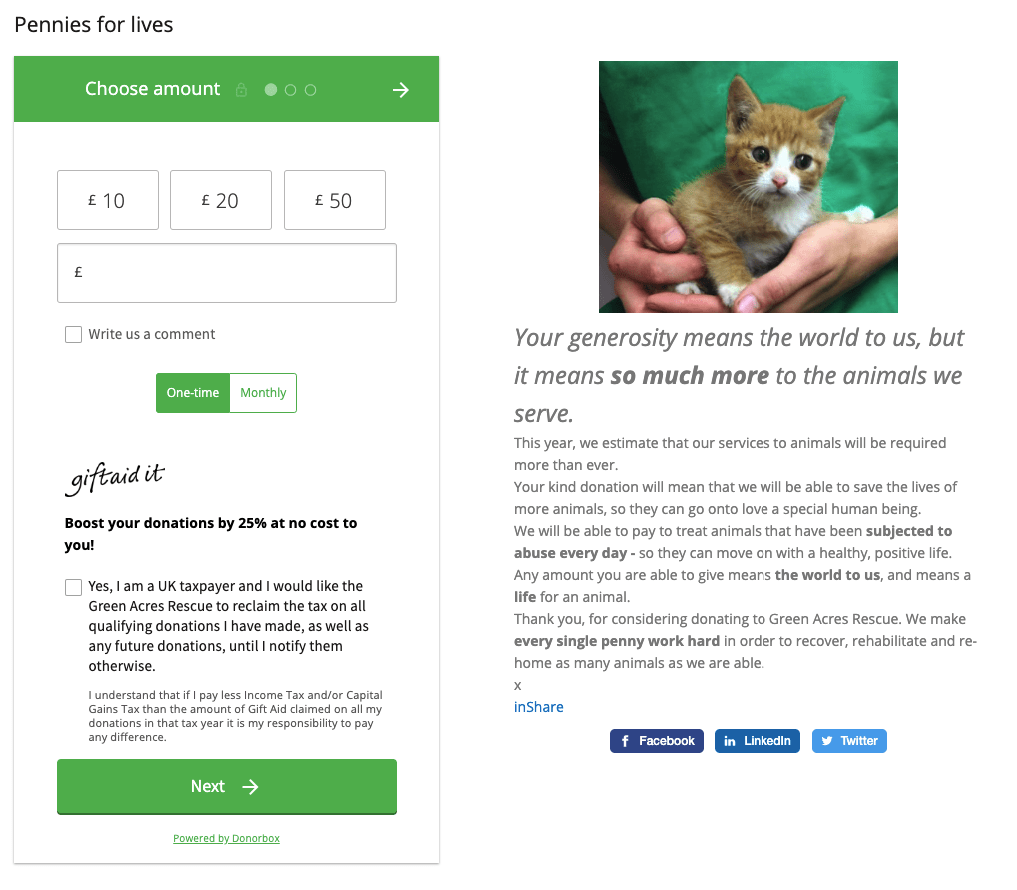

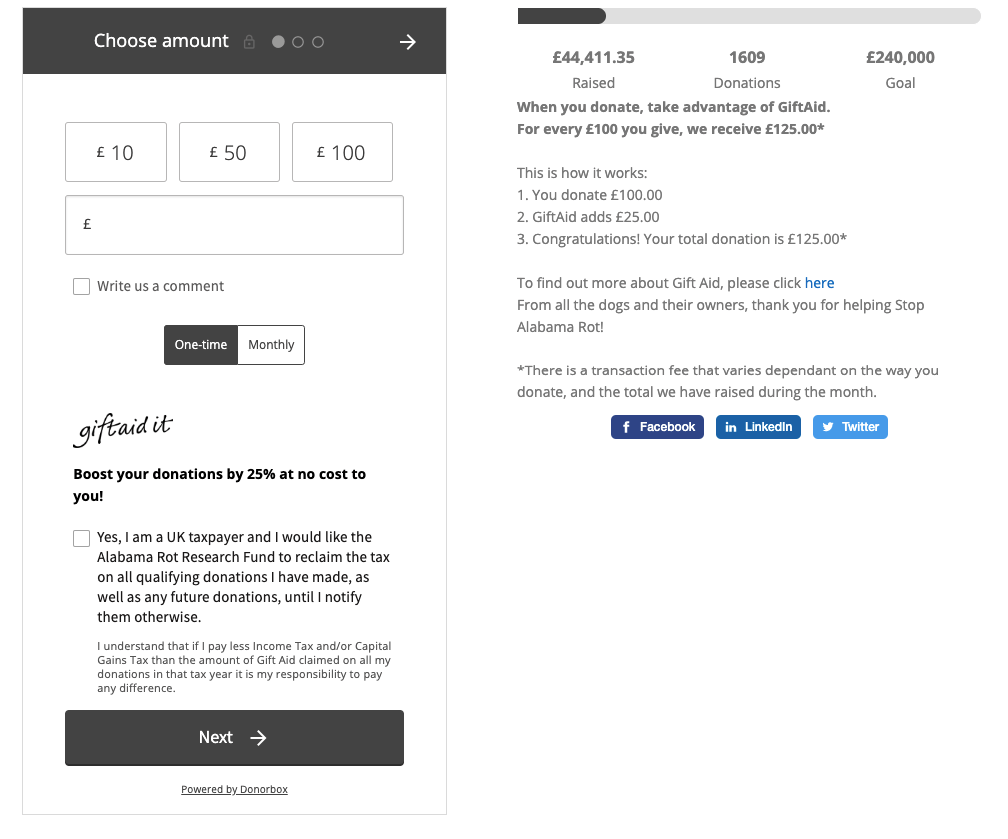

These UK organizations are using Donorbox to accept Gift Aid:

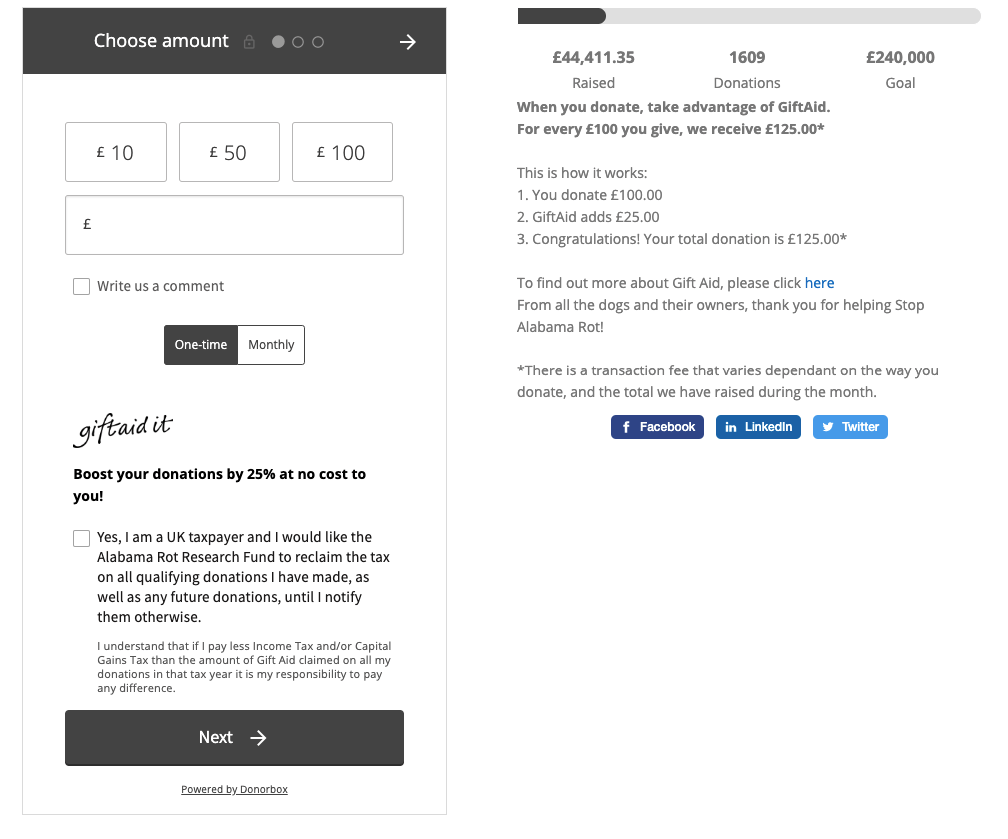

Stop Alabama Rot highlight the impact of Gift Aid on donations in their campaign text to show the real-world impact:

And many more like Hello World, Stonewall, Positive Steps, National Aids Trust, etc.

Over to You

Enabling your UK donors to allow you to claim Gift Aid is an easy way to boost your eligible donations by 25%. This can maximize the impact of their donation.

It’s easy to set up your Donorbox account to enable Gift Aid contributions. In just a few clicks, your Donorbox donation form allows your donors to mark their donations as Gift Aid.

Take a look at our Nonprofit Blog for more resources on getting the most from your fundraising and maximizing donations.