Everyone dreads tax season. Whether your organization follows a fiscal or calendar year, the timing may not always be convenient. Luckily, the Internal Revenue Service (IRS) gives nonprofits the option to extend this deadline by filing Form 8868.

Nonprofits usually file form 990 on an annual basis with the IRS before the 15th day of the 5th month. However, with form 8868, they get the chance to extend this time by 6 months. This gives them time, plus, there’s no risk of accidentally missing the deadline.

Just like other IRS forms, form 8868 can also seem complicated. But in this blog, we have provided you with step-by-step directions on how to file Form 8868, along with the answer to a few questions that may come up in the meantime. Here’s what you should expect from the blog –

- What is Form 8868?

- When to File Form 8868

- How to File Form 8868

What is Form 8868?

With form 8868, the IRS once offered one automatic extension for 3 months with a subsequent 3-month extension if an organization applied for it. After January 2020, the IRS changed its terms to provide a 6-month extension to all exempt nonprofits. So if a nonprofit organization is willing to extend the deadline of filing their tax return, they should essentially file the form 8868.

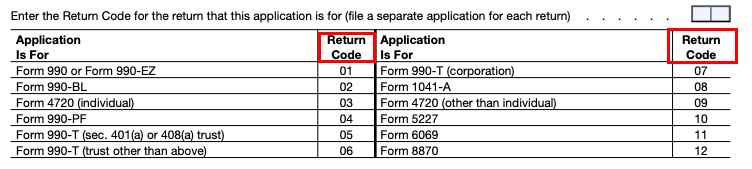

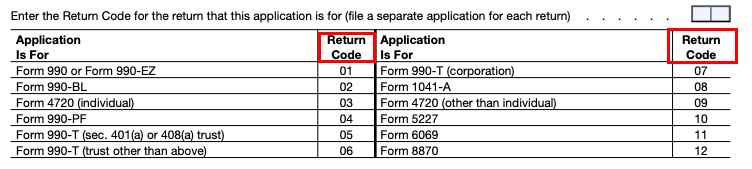

Form 8868 can be filed by organizations filing the following returns:

- Form 990 or form 990-EZ are the tax returns used by organizations that have received tax-exempt status from the IRS. Organizations use this form with annual gross receipts over $200,000. 990-EZ is used by organizations with annual gross receipts between $50-$200,000. After July 31, 2021 Form 990-EZ must be filed electronically.

- Black lung benefit trusts file Form 990-BL to report and pay required taxes.

- Form 4720 is the return of certain excise taxes (taxes imposed on various goods, services, and activities) on charities and persons under chapters 41 and 42 of the Internal Revenue Code. Should be used with Form 990-PF to figure and report these initial taxes.

- Private foundations and non-exempt charitable trusts file Form 990-PF if they file at least 250 returns annually. Organizations must include a list of their assets, financial activities, trustees and officers, and a complete list of grants awarded.

- Form 990-T is used by tax-exempt organizations to report unrelated business income, report proxy tax liability, and claim a refund of income tax paid by a real estate investment trust (REIT).

- Trusts that claim charitable deductions must use Form 1041-A.

- Charitable Remainder Trusts, pooled income funds, and split-interest trusts must file Form 5227.

- Form 6069 is used by tax-exempt black lung benefit trusts to find the maximum allowable income tax deduction.

- Charitable organizations and charitable remainder trusts use Form 8870 to report premiums paid on life insurance, annuity, and personal benefit contracts.

Note: Extensions with form 8868 are not applicable for form 990 N which is used by some small tax-exempt organizations for annual reporting purposes and is a purely electronic form.

When to File Form 8868

All nonprofits follow a fiscal or calendar year to determine the beginning and end of the financial year and its budget. The IRS allows nonprofits to use either an organization’s fiscal year or the calendar year to determine when they must file their annual taxes.

If a nonprofit follows the calendar year, its taxes are due by May 17, 2021. If they follow a different fiscal year, their due date is the fifteenth day of the fifth month. Nonprofits who cannot finalize their tax forms by this due date will receive a six-month extension to file their tax returns.

To get this extension from the IRS, nonprofits must file Form 8868 and pay any taxes due by the original date. This form must be sent separately from the return instead of attaching it to the tax return when it is filed.

How to File IRS Form 8868 (+ Instructions)

IRS forms can be confusing. Therefore, we have created a step-by-step guide for you to follow when filing Form 8868 for an extension. You may want to have a look at the form at the same time to understand the steps better.

- Contact Information

- Return Code

- Taxpayer Identification Number (TIN)

- Tax Exemption Details

1. Contact information

1.1 Organization’s name

The first step to file Form 8868 is to include the basic information for your organization. First, of course, is your organization’s name. Your name must match the name entered when you filed your Articles of Incorporation with the state and with the IRS when applying for tax exemption.

1.2 Address

After your name, you must add the organization’s primary address. This address must include the location’s building number, street, and room or suite number. The IRS does allow nonprofits to use a P.O. Box to file this form.

Many nonprofit organizations use outside accountants or other third-party organizations to receive tax information on their behalf. These organizations should include the accountant or third-party business in this section. Enter C/O followed by the name and address or P.O. Box of the individual or company.

1.3 City, state, and zip code

Once you have entered the location’s address, remember to include the correct city, state, and zip code. If you have a foreign address, you can use that address. Just add it in the following order: city, province or state, and country with the correct postal code.

It is essential to file the same information here as is on all other information with the IRS. If your organization’s mailing address has changed, file Form 8822 to change your address with the IRS. You cannot update IRS information with Form 8868.

2. Return code

Once all contact information is there, you must enter the correct return code. This code is there on the form next to the tax return you will be filing at the end of your extension. Since it varies with each form type, be careful to have a thorough look at it and note the correct number.

3. Taxpayer Identification Number (TIN)

Along with the return code, your organization must enter its Taxpayer Identification Number (TIN). Every organization has a unique TIN. Your TIN, or EIN, is listed on the tax-exempt letter you received from the IRS.

4. Tax exemption details

Finally, you will need to address the timing of your extension and the amount of taxes you need to pay.

4.1 Line 1

On line one, you should enter the exact dates needed for your 6-month extension. You must also enter whether your nonprofit follows the calendar year or include your organization’s fiscal year dates.

4.2 Line 2

If your organization enters less than 12 months on line one, you must check the reason. The choices given are:

- Initial return

- Final return

- Change in Accounting Period

If you check the ‘Change in Accounting Period’ box, make sure you have applied for approval to change your tax year before filing this extension.

4.3 Line 3a and 3b

This is where the form can get confusing. Before this line, be sure to check the tax return you plan to file and read the instructions on determining the taxes you will pay minus any non-refundable credits. We have written an article to make this easier for nonprofits that file 990 Forms.

If you expect this number to be zero, enter 0 on this line.

Line 3a is used for Forms 990-BL, 990-PF, 990-T, 4720, and 6069.

Line 3b asks those filing Forms 990-PF, 990-T, 4720, and 6609 to enter refundable credits and any estimated tax payments made. You should also enter any overpayment from the prior years that can work as a credit.

4.4 Line 3c

On line 3c, you will subtract line 3b from 3a. The amount will be the balance due from your taxes. To avoid paying any interest or penalties, you must include this amount with Form 8868 when filing for your extension.

Form 8868 can be filed online, and your taxes can be paid through the Electronic Federal Tax Payment System (EFTPS) or by mail to the Department of Treasury.

Conclusion

Hopefully, this article helps you file for an extension with form 8868. As you have read, the process is not as complicated as you think. The IRS has several resources for nonprofits to file for the extension of their tax returns.

Nonprofits must remain aware of tax changes that affect not just your organization but your donors as well. If your organization has locations in other countries, visit our blog post on Nonprofit Tax Programs around the World to learn how their taxes can change depending on the country where they reside.

Donorbox has more resources for nonprofits that answer questions regarding online fundraising, board development, and more. If you are searching for an online donation processor at an affordable price, visit our website for a list of tools and features.

Frequently Asked Questions (FAQs)

Here we’ll answer some of the common questions you might have on form 8868.

1. Can you get extensions for multiple returns at a time?

Your organization will have to file a separate Form 8868 for each return where you need an extension.

2. Will you be penalized if you do not pay taxes by your original due date?

The IRS expects nonprofits to pay taxes by the original required due date. If your organization does not pay the necessary amount when filing for an extension, you will be charged interest. Typically, a late payment penalty of ½ of 1% of any tax that is not paid will be charged each month or part of the month that the taxes remain unpaid.

If the amount on 3a is at least 90% of the tax balance due, and you pay the balance by the extended due date, you will not face any charges.

3. Can you mail Form 8868? If yes, what is their mailing address?

The IRS does accept this form online and by mail. You can mail your extension Form 8868 and expected tax amount to:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0045