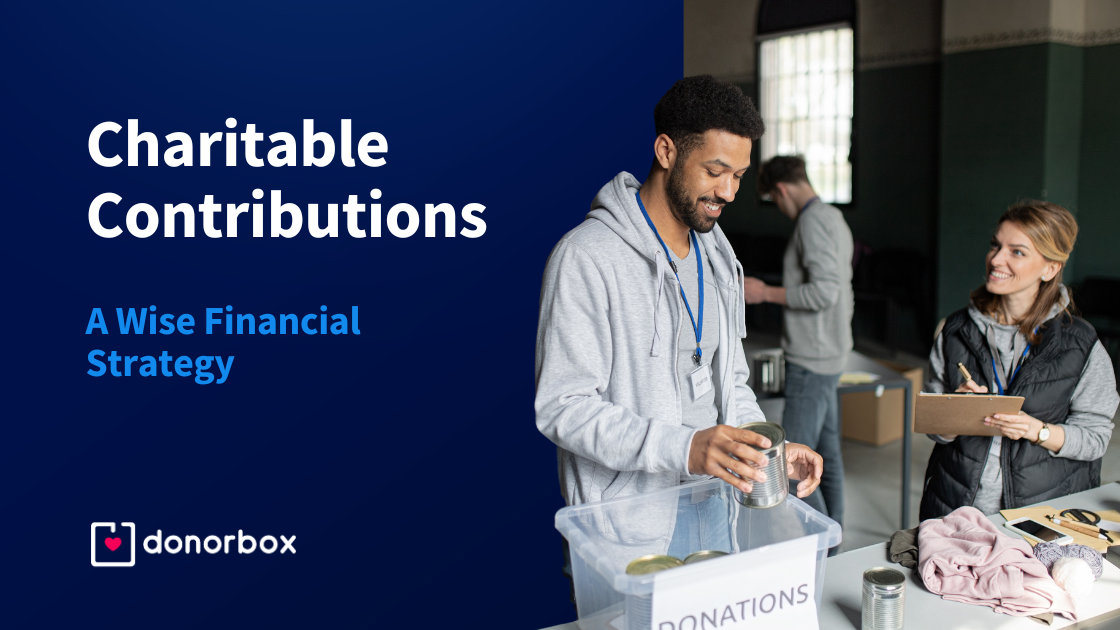

Charitable contributions are a traditional method of lowering taxable income for many people, along with HSAs and IRAs. Contributions made to qualified organizations in the current calendar year are eligible for deductions on your taxes next year.

While donations are a great way to save money on taxes and can be part of a wise financial strategy, there are a few things to consider before giving.

How Much Can You Donate to Charity for Taxes?

According to the Internal Revenue Service (IRS), if you donate cash assets to a qualified organization during the previous year, you can deduct 60% of your annual gross income (AGI). This means you may deduct costs that don’t exceed 60% of your AGI.

In-kind donations, however, have separate rules. Non-cash donations are limited to 50% of your AGI. Capital gain property gifts are limited to 30% of your AGI. If you donate a product or service designated as “for the use of” an organization, you are limited to a 20% or 30% tax deduction.

When you receive a benefit in return for any contributions, such as event tickets or auction items, you may deduct only the amount of your contribution that is more than the value of said benefit. This is called the fair market value (FMV). If you contributed more than the FMV and you paid it with the intent to make a donation, the excess is considered a charitable contribution by the IRS. The qualified organization you are donating to should be able to tell you the FMV for the benefit you received.

What is a Qualified Organization?

Your charitable donations are tax deductible when made to qualified organizations, including:

- Churches, synagogues, mosques, and other religious organizations

- Federal, state, or local government activities like the fire department or public parks

- Nonprofit schools and hospitals

- Other 501(c)(3) organizations

- Expenses paid for a student living with you who is sponsored by a qualified organization

- Out-of-pocket expenses you paid when volunteering for a qualified organization

How Does Giving Affect My Tax Bracket?

Donating to charities can not only save you money on taxes but can lower your tax bracket, providing even more benefits. This is particularly helpful if you get a raise and make enough money to get bumped into the next tax bracket.

Here is a brief representation of the current tax brackets:

| Tax Rate |

Single Filers |

Married and Filing Jointly |

| 10% |

$0 to $11,000 |

$0 to $22,000 |

| 12% |

$11,000 to $44,725 |

$22,000 to $89,450 |

| 22% |

$44,725 to $95,375 |

$89.450 to $190,750 |

| 24% |

$95,375 to $182,100 |

$190,750 to $364,200 |

| 32% |

$182,100 to $231,250 |

$364,200 to $462,500 |

| 35% |

$231,250 to $578,125 |

$462,500 to $693,750 |

| 37% |

$578,125 and above |

$693,750 and above |

Need an example? Let’s say you are single and make $50,000 a year. The current tax bracket shows that you’ll pay 10% on the first $11,000, 12% on the next $ 33,725, and then 22% of the remaining $5,275 to reach your annual salary.

If you donate 20% of your income to charity, your taxable income will drop to $40,000, which means you aren’t paying anything in the 22% tax bracket and only $29,000 in the 12% tax bracket. That’ll save you about $1,700 in taxes.

Conclusion

Charitable contributions can certainly be a wise financial strategy by saving you money during tax season. It’s important to consider these questions and more, however, before making philanthropy part of your financial planning.

Keep in mind that this article is meant as a short overview, and there are stipulations and additional taxes in many brackets. We recommend that you wait to start writing checks until you can review the IRS website and consult a tax advisor to ensure your donations are tax deductible.

Rebekah Doty

Rebekah is the Head of the Customer Success & Intelligence team at Donorbox, ensuring nonprofits and individuals receive the best support at all times. Under her guidance, Donorbox is able to create friendly and meaningful relationships with their customers.