Nonprofits now can Receive Donations via ACH Bank Transfer!

Donorbox allows you to accept ACH bank transfer donations from your supporters. You can easily have this option added to your Donorbox donation form. Learn how in this guide!

Donorbox allows you to accept ACH bank transfer donations from your supporters. You can easily have this option added to your Donorbox donation form. Learn how in this guide!

The Donorbox team is thrilled to introduce an exciting new feature for all U.S. based organizations. Our donation forms now accept ACH bank transfer (also known as eCheck) payments! In other words, your supporters can now make donations through bank transfers instead of using their credit cards or PayPal accounts.

This is particularly helpful for large donations, as credit card fees are almost three times more expensive than ACH fees. In fact, Stripe charges a 2.2% + $0.30 credit card fee for registered 501c3 nonprofits, while its ACH fee is only 0.80% and is capped at $5 (i.e. if you donate above $625, the fee remains at $5).

Our Donorbox platform fee of 1.75% is capped at $25 for ACH bank payments. That means for an ACH donation that exceeds $1,667, the maximum platform fee we will charge for that donation is $25.

Donorbox charges a 1.75% transaction fee. However, if you upgrade to our Pro plan at only $139/month, the transaction fee is further reduced to a flat 1.5% for all of our fundraising tools.

So, let’s take an example of a $1000 donation. If it is an ACH payment, the fee would be $22.5. If it is a credit card payment, the fee would be $39.8. Whether you or your donors pay these fees, the lower they are, the better.

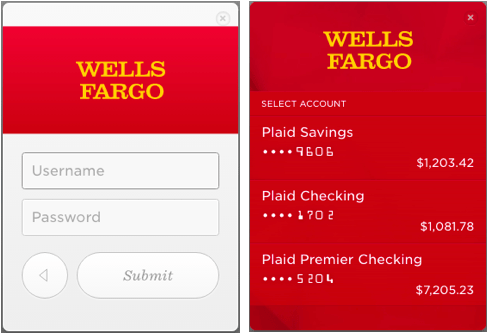

This feature is especially practical in that donors don’t have to type in their bank account and routing numbers in order to perform a bank transfer. Instead, they simply log in using their online banking credentials (username & password), making the checkout process much faster and more secure.

This payment method is provided by Stripe in partnership with Plaid, a financial technology company.

You must have a U.S. Stripe account in order to take advantage of ACH payments. While Stripe will be doing the backhand work and actually moving the money, Plaid is in charge of the secure bank login.

This flow was designed with security in mind, which you can learn more about here. A few examples of other successful organizations currently using Plaid’s technology include Gusto, Venmo, and Charity Water.

First off, connect your Donorbox account with Stripe. This will make the option “Accept US bank transfer donations” appear for you.

This feature is turned off by default. On your Donorbox account setting and click on the “Payment Method” menu item on the left. On the Payment Method page, you will find the “Enable ACH Bank Transfer Donation” toggle button. Switch it ON!

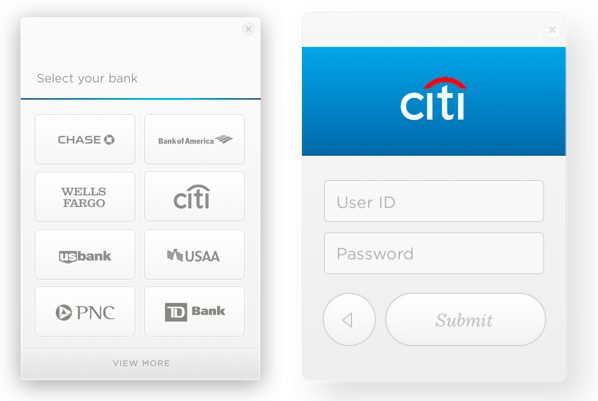

Now, a new “Bank Transfer” tab will appear at the top of your donation form’s payment page.

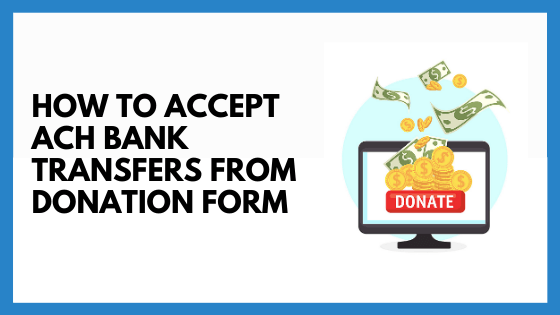

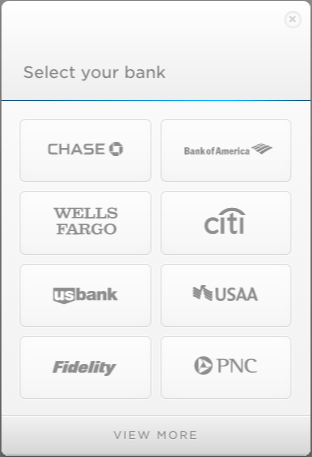

Once your donors have entered their personal information and are ready to donate, a screen will pop up allowing them to choose their bank.

They will then be prompted to log into their online banking account using their username and password and choose the account (checking, savings, etc.) they wish to pay with.

Once they’ve selected their account, the transfer will be initiated and your donation will be processed! It’s that easy.

Please note that newer Stripe accounts just establishing their history with Stripe may be capped at a $2000 ACH bank transfer limit. If you’d like this limit to be raised earlier, please feel free to contact Stripe support.

If you have any questions, comments, or concerns, feel free to contact us at .

Bonus Resource: What are the best donation payment options nonprofits need to have to maximize donations and why? Check out this video to learn more:

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.