Donor-advised funds (DAF) have become a popular fundraising trend, especially for major donors. DAFs give donors more control over their gifts and more flexibility in how to spend them. Nonprofits can also use DAFs as an indicator of major donor prospects.

This article will share more about DAFs, how you can start one, the benefits of DAFs to donors and nonprofits, and how they differ from private foundations.

What is a Donor-Advised Fund or DAF?

Donor-advised funds started in the 1930s but were not officially part of the Internal Revenue Service (IRS) code until 2006 when George W. Bush signed the Pension Protection Act. This law allowed donors to give more to charity and save more on taxes. With donor-advised funds, donors immediately receive a tax deduction when contributing and can suggest who will receive the gift and when.

If the donor doesn’t want to take an active role after that, they can step away and let the DAF sponsor take control.

The 4 Important Steps Involved in DAFs

Donor-advised funds have become so popular because they make it easy to give. There are only a few steps to follow, and donors can see immediate benefits.

1. Open an account with a hosting public charity

Donor-advised funds start when an individual, family, group, or company invests at least $10,000 with a 501c3 sponsoring organization. Once the individual gives to the DAF, the organization has legal control over the funds, but the donor can advise the organization on where to send charitable gifts. Some sponsoring organizations have acted questionably in the past, so the IRS has added new procedures and guidelines to ensure organizations use funds correctly.

Donors interested in starting a DAF can contact companies like Fidelity Investments or Charles Schwab, and work with a community foundation, or alumni association.

2. Receive an immediate tax deduction

Since DAF sponsoring organizations are 501c3 organizations, donors receive a tax deduction once they contribute to a donor-advised fund, even before funds reach the charity. Many nonprofits are concerned about this donor benefit because funds do not go to the organizations immediately.

Jennifer and David Risher started #HalfMyDAF in 2020 in response to this concern and the Covid-19 pandemic. Thanks to them, donors willing to give half their DAF funds right now receive matching grants and make twice the difference.

3. Choose how to use your gift

DAF sponsoring organizations may have legal control, but donors can still advise how to use their gifts. Donors can tell DAFs to contribute to their favorite charities and give anonymously. Donors can also name family members or friends as advisors and create a legacy plan to ensure the gift continues after their death.

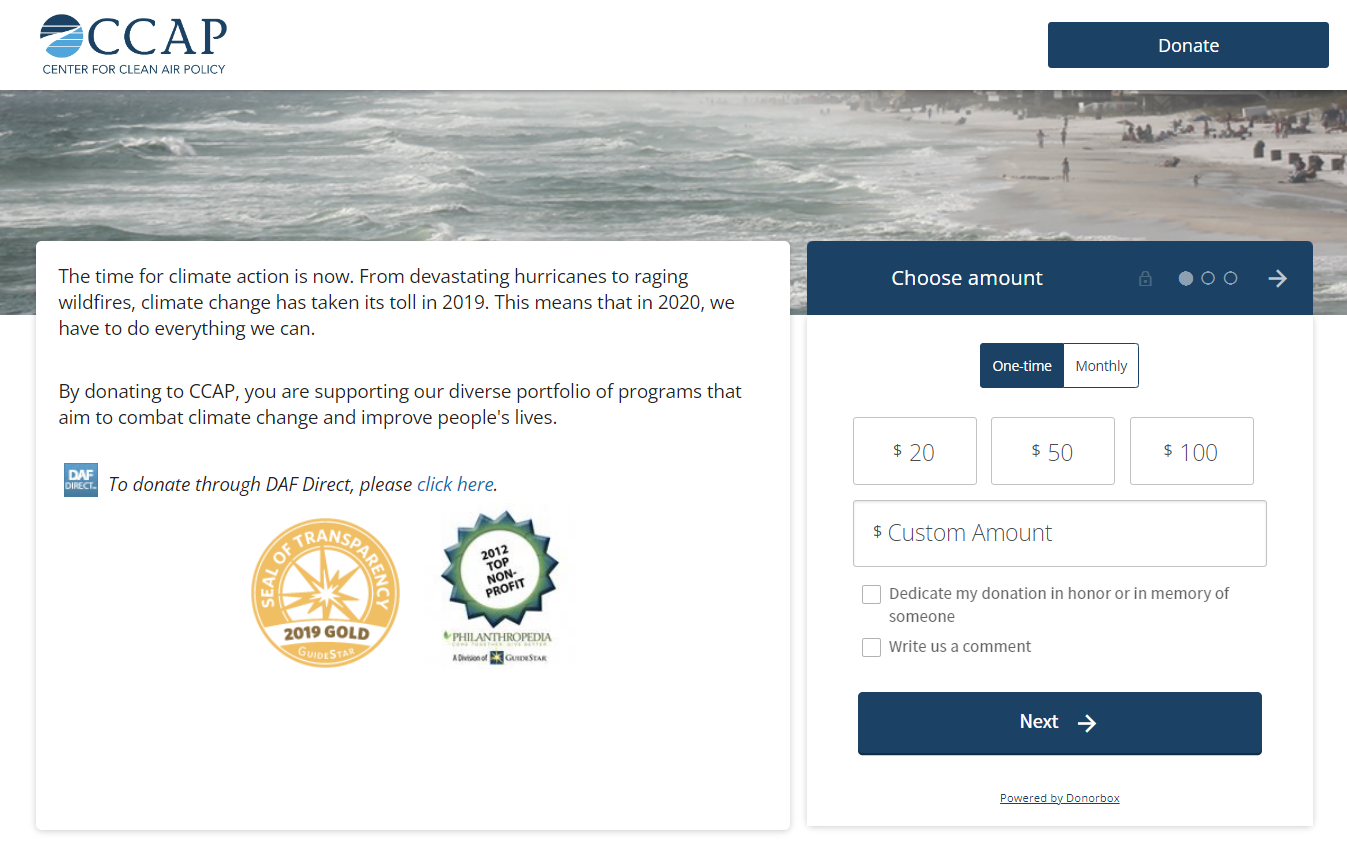

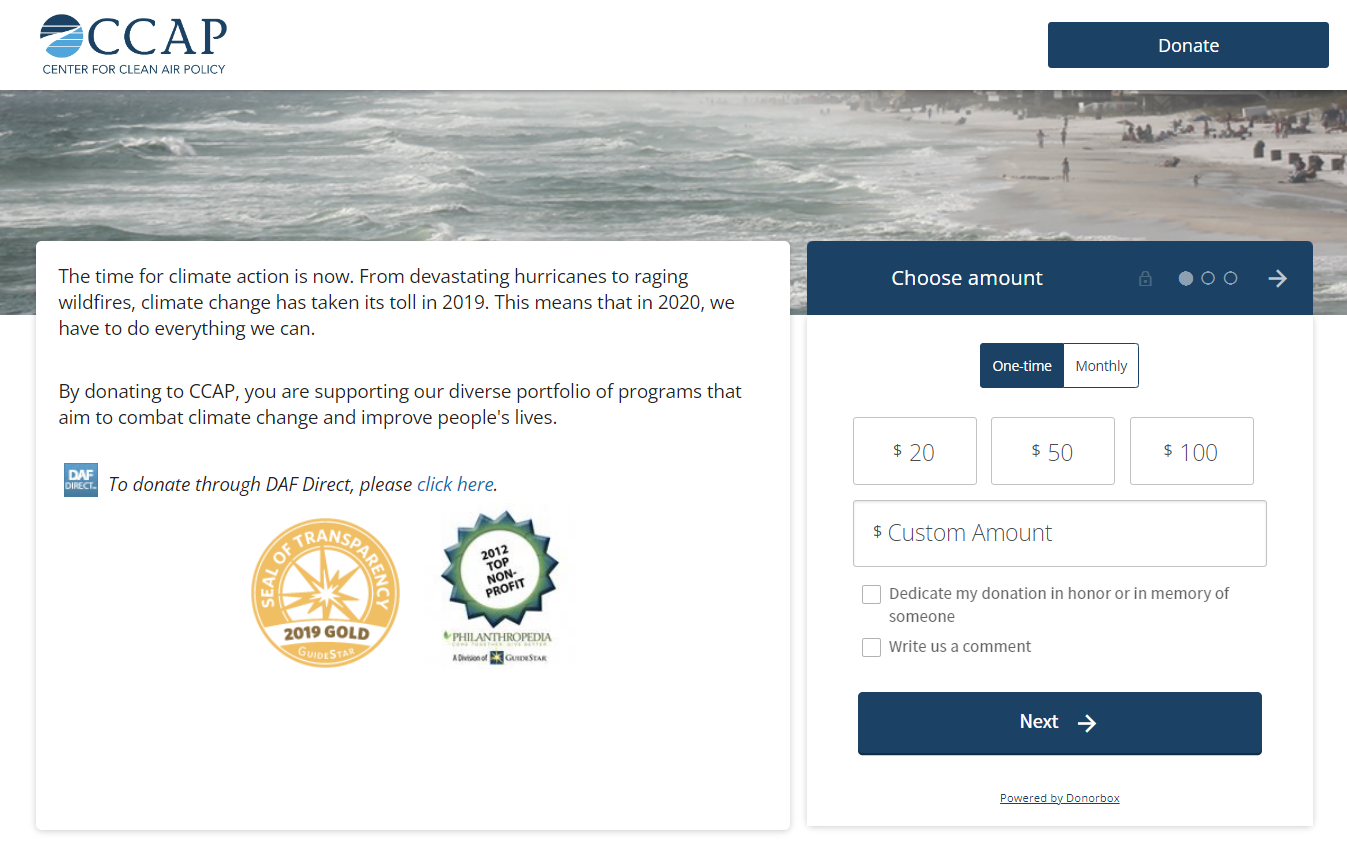

In the below example, the Center for Clean Air Policy has provided a way for donors to direct their DAF funds to their charity. This is a great way to let donors know that a nonprofit is open to accepting DAF funds; actually, a good way to even educate them on this new way of giving.

4. Invest to ensure DAF growth

Donors can also invest in DAF assets to ensure long-term growth. Many sponsoring organizations provide donors with a list of investment recommendations. All income from DAF investments is tax-free.

Benefits of Donor-Advised Funds

1. For donors

Donor-advised funds have become popular because of the flexibility they offer to donors. With DAFs, donors can send gifts immediately to their favorite charities or hold funds for the future. DAFs also allow donors to split gifts among several organizations without the responsibility of starting their own foundation.

Other donor DAF benefits include –

- Immediate tax deduction.

- Tax-free investment earnings.

- Can contribute cash, stocks, cryptocurrency, private business interest, real estate, etc.

- Option to nominate a financial advisor to manage charitable donations.

- Time to create a philanthropic strategy or legacy plan.

- You don’t have to keep track of acknowledgments for tax purposes.

- Ability to help international nonprofits while still receiving the tax benefit.

2. For charities

Donors are not the only ones who benefit from donor-advised funds. Since Donors can invest DAF funds and receive tax-free earnings, nonprofits may continue to receive funds if the DAF investment is successful. Because of the tax benefit feature, many major donors show greater interest in opening a DAF account. However, nonprofits should educate and convince donors on how their DAFs can have an immediate impact in order to receive the funds immediately.

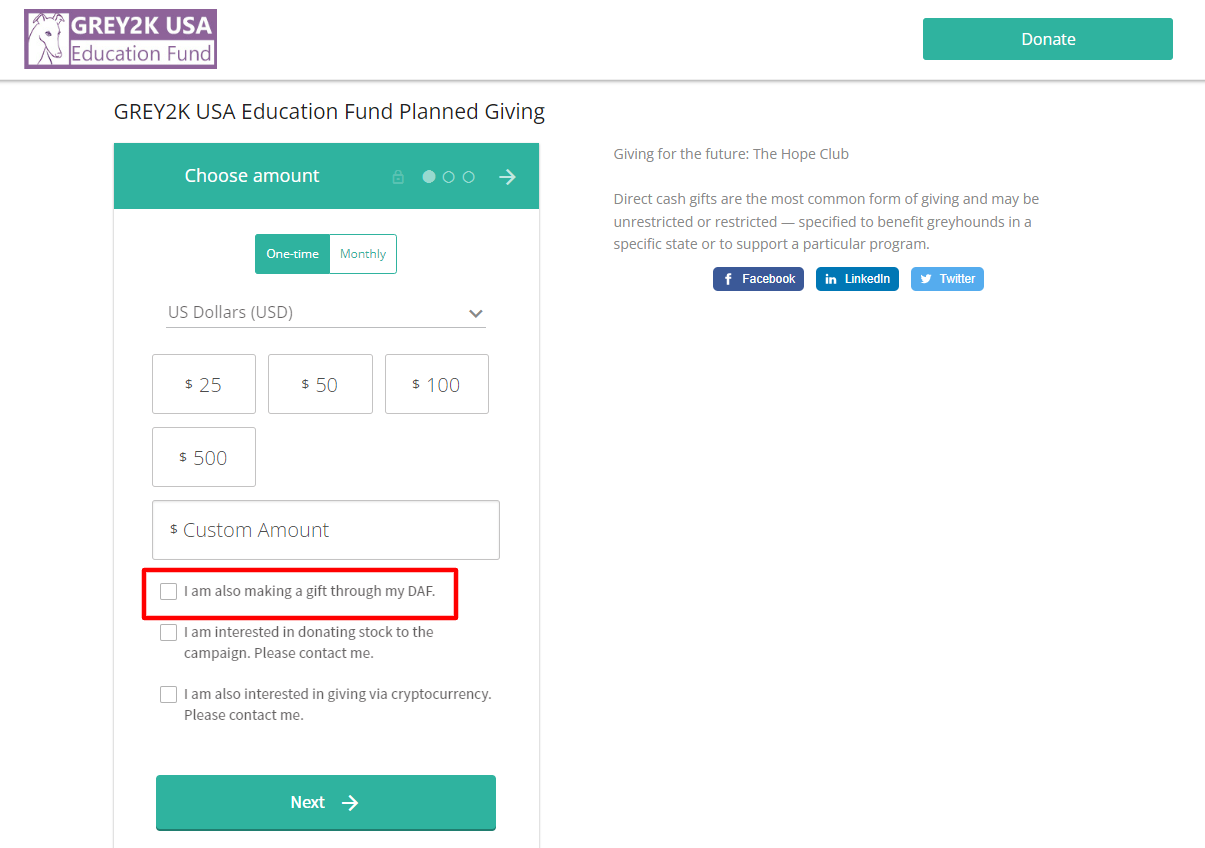

If your nonprofit hopes to encourage more DAF gifts, you must include a page on your website explaining how you can work together. Or use a donation form that asks donors if they have a DAF fund. It’s naturally a better way to grab the eye than mention it in one of the sentences of a big campaign description. See how GREY2K USA Education Fund does it with the help of the customizable Donorbox recurring donation form.

Get Started With Donorbox

Limitations to Donor-Advised Funds

Donor-advised funds are not always the best choice for donors and nonprofits. A few restrictions may convince donors to look for other options and nonprofits to not consider this donation option at all.

DAFs cannot:

- Support non-501c3 organizations.

- Suggest grants that provide a personal benefit to the donor or their family.

- Make a Qualified Charitable Distribution (QCD) from your Individual Retirement Account (IRA).

DAFs also include fees that may mean a donor’s gift is less than they would make with a one-time donation.

On the nonprofit side, since DAFs do not have an annual payout requirement (unlike private foundations), funds often get delayed. For a number of reasons, donors postpone the funds. Either they’re not able to decide on a cause or a charity or aren’t sure about donating to the nonprofit. A lot of DAF funds are often left unspent. Hence, many charities aren’t keen on going the DAF way when it comes to accepting donations. They prefer private foundations and other charitable giving to donor-advised funds.

Comparison Between DAFs and Private Foundations

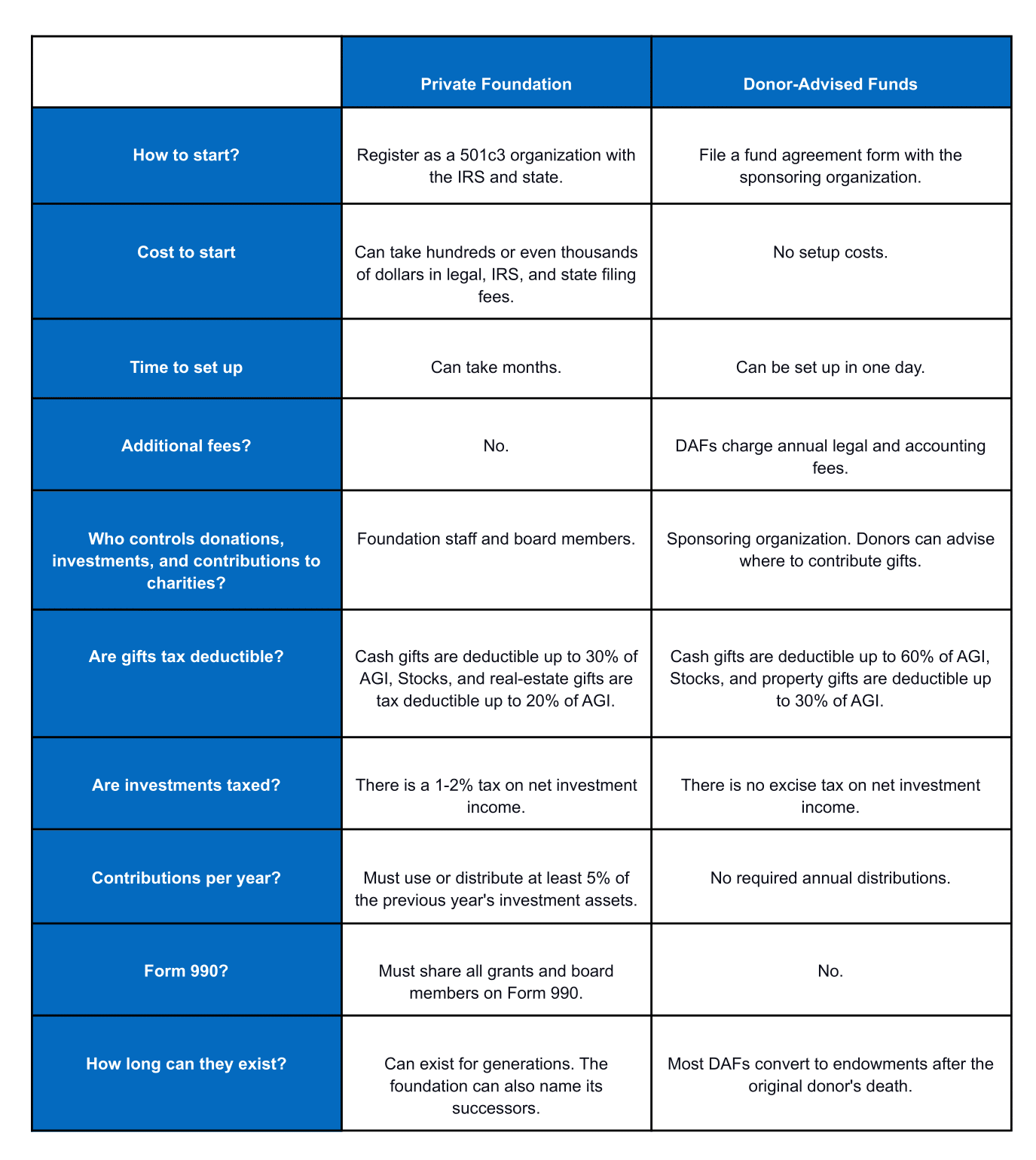

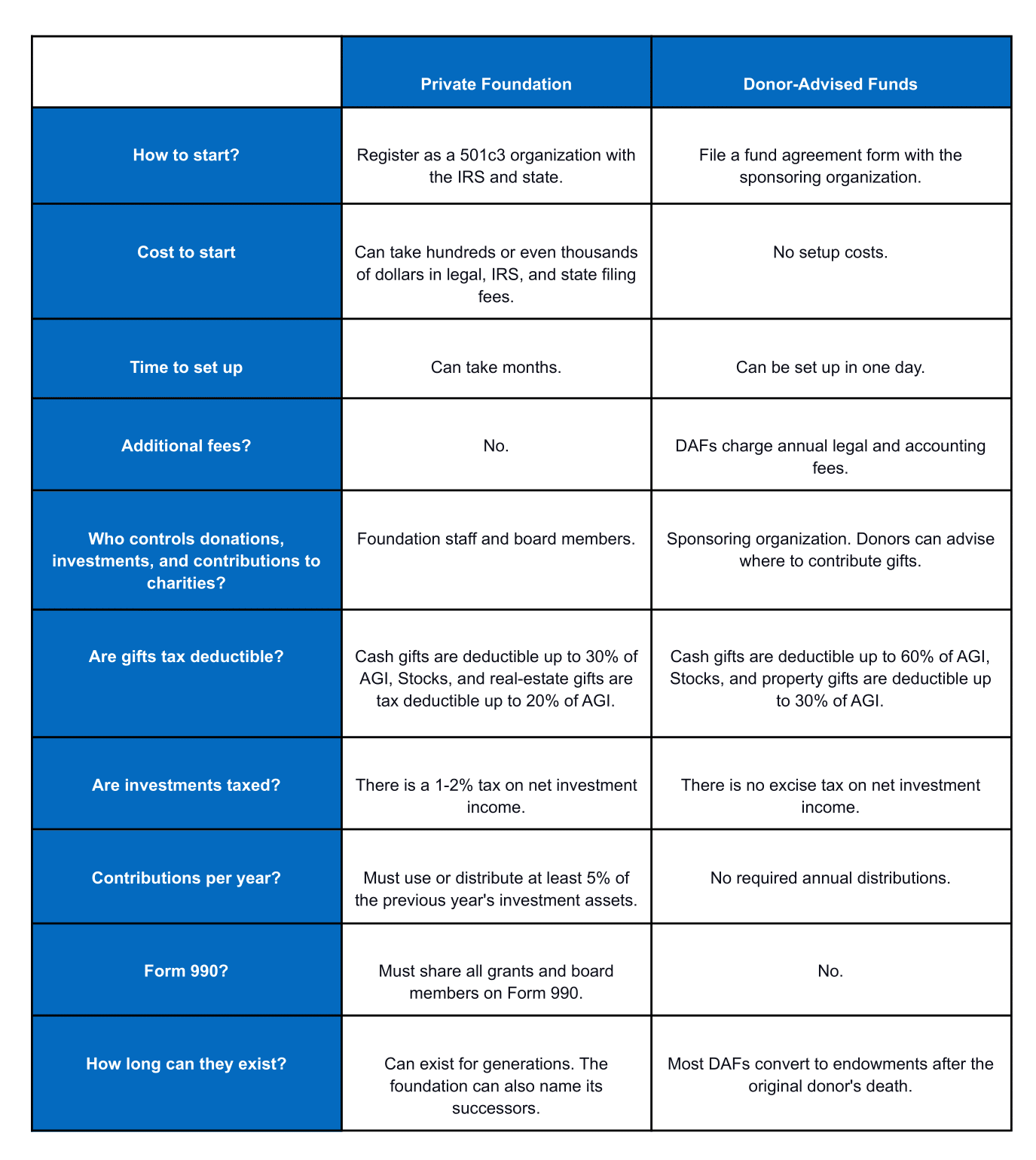

Major donors looking for ways to contribute significant amounts to more than one organization must choose between donating to DAF or starting a private foundation. Since donors do not have to manage DAFs, this may seem an obvious choice, but they must consider several differences between the two before making a decision.

We’ve created the below table to explain the differences between DAFs and private foundations. As you can see, choosing between the two greatly depends on why you’ve decided to give.

Final Thoughts

Donor-advised funds are a flexible option that allows donors to choose where, when, and how to use their funds. Major donors who don’t want to deal with all the administrative requirements of a significant gift can support their favorite charities and see benefits immediately. While DAFs may seem like an ideal option for most major donors, there are several reasons donors and nonprofits may want to make another fundraising choice.

And what better way to fundraise than using online fundraising methods like fundraising campaigns, recurring donation programs, memberships, ticket sales, crowdfunding, etc.? They’re convenient for nonprofits as well as donors, offer more control over the money being spent or received, where, and when, and help nonprofits manage donors in a better way. Donorbox is a one-stop shop with all these features in place and more for nonprofits and organizations, while also being the most cost-effective and simple choice for them. We’ve enabled 80,000+ organizations to raise over $2 billion in donations.

But we’ve no intentions of stopping here. Hence, we’ve come up with Donorbox Premium – a success package designed for all kinds of nonprofit organizations. You’ll have access to expert coaching services, a team of tech wizards solving your tech issues on time, a dedicated account ambassador, and dynamic tools to boost your fundraising efforts. Pricing is personalized for each organization. Book a demo today!

Read insightful blog posts and find downloadable resources on nonprofit management, fundraising tips and ideas, and donor management on the Donorbox Nonprofit Blog. Subscribe to our newsletter to receive our best resources including articles, podcast episodes, webinars, product updates, and more in your inbox every month.