Did you know there are billions of dollars left unclaimed by nonprofits every year?

Unfortunately, it’s true—up to 10 billion potential fundraising dollars are left on the table annually. But, fortunately, there’s a way that we can start to change that.

How? By pushing to maximize donations through the power of matching gifts!

In this article, we’ll go over the basics of matching gifts and show you how your nonprofit can benefit from these programs.

Specifically, we’ll answer the following questions:

- What are matching gifts?

- How do matching gifts work?

- What nonprofits are eligible?

- What does this process look like?

- How can nonprofits promote matching gifts?

- How do nonprofits integrate matching gifts with DonorBox?

- Can nonprofits measure matching gift performance?

- What are some common challenges organizations face?

Matching gifts are a great way to take back those extra fundraising dollars, but you can’t take advantage of these programs if you don’t know how!

Ready to learn? Let’s get started.

1. What are matching gifts?

Coming up with exciting, fresh fundraising ideas can be a difficult game. Luckily, the process of matching gifts is both easy and profitable.

If you’re unfamiliar with matching gift programs, the concept is simple: companies match their employees’ gifts to eligible nonprofits.

In many cases, that means the employer will literally double the gift. Your donor’s $50 becomes $100, $200 becomes $400, and so on.

Matching gift programs can be a great way to boost your general fundraising abilities, and they can also play a strategic part in helping you reach specific targets. Especially if you’re chipping away at large-scale projects (like a capital campaign), these additional funds can really add up!

These programs are put in place by employers to encourage charitable giving among their employees. Clearly, they’re great for nonprofits, who can get an instant boost to their fundraising, and they’re also beneficial for the companies.

Employees of companies with matching gift programs tend to be more engaged with their workplace and therefore more likely to stay at the company. Companies also receive tax benefits and a boost to their philanthropic reputation.

It’s no surprise, then, that 65% of Fortune 500 companies have matching gift programs in place!

Bottom Line: Corporate matching gift programs are a simple way to double employees’ donations to eligible nonprofit organizations. Many companies already have these programs in place, but most nonprofits don’t take advantage of them.

2. How do matching gifts work?

The process of matching gifts is simple, but there are a few basic components that you should understand as you get started.

First, it’s important to know the ratio at which a company will match donations.

By and large, most companies will give at a 1:1 (or dollar-per-dollar) rate, therefore doubling their employees’ donations.

However, while that may be the most common ratio, it’s not the only ratio you may encounter! Some companies match at .5 to 1, while others are so generous as to triple donations. There is no universal ratio, so you’ll have to work with companies on an individual basis.

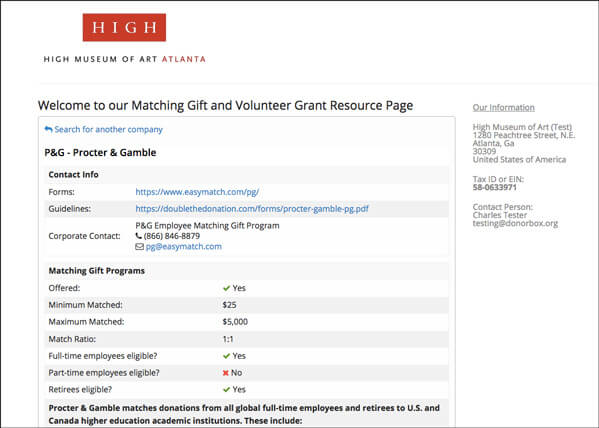

While we’re talking numbers, you should also be aware of minimum and maximum matching gift limits.

Companies set minimum and maximum donation thresholds for the gifts they’ll match. The average minimum is around $25, while the maximum amounts are generally between $10,000 and $25,000.

As with ratios, there’s no universal standard for these amounts. Companies determine their own limitations, so you’ll need to do your research to find out the specifics.

Bottom Line: The matching gift process is simple, but there are some key elements to keep in mind. Be aware of companies’ varying match ratios, as well as minimum and maximum donation amounts.

3. What nonprofits are eligible?

Whether you’re a well-established organization or just starting out, you may be eligible to take advantage of these awesome corporate giving programs.

The good news is that the vast majority of registered nonprofit organizations are eligible for matching gift programs.

Educational, social, environmental, cultural, and healthcare-focused organizations or institutions are generally qualified for corporate matching gifts.

With that in mind, there are some organizations that generally are not eligible. These organizations include religious groups without a community-service component or organizations with a political affiliation.

Additionally, some companies narrow their focus to include only specific types of nonprofits. For example, a corporation may prefer to match gifts only to educational institutions, such as private universities or K-12 schools.

Since these restrictions may vary by company, the best way to know for sure if your nonprofit is eligible is to check with businesses individually.

Bottom Line: Most registered 501(c)(3) organizations can participate in matching gift programs, but companies can further limit the organizations they will donate to at their own discretion.

4. What does this process look like?

Now that you’re aware of the basics of gift matching, let’s take a more detailed look at the process from start to finish.

The first step to matching gifts is the gift itself—your donor has to make a contribution before their employer can match it!

Following the initial donation, the donor can check to see if their employer has a matching gift program in place. If the nonprofit has a matching gift tool on their website, this step can be as simple as searching for a company name and following the instructions from there.

The donor must complete the associated paperwork (or online form) to provide information about their gift. Usually, this includes the date of the donation, the donation amount, and the payment type.

At this point, it’s also important to consider the matching gift deadlines that a company may have in place.

While donors aren’t required to submit their requests immediately following their donation, there are general time constraints that must be followed.

Usually, that means the request must be submitted within:

- A set number of months (usually 3 or 6).

- The calendar year.

- A year and 1-2 months.

If the request is within the company’s set parameters, the donor may submit their request online or by mail.

So, where does the nonprofit come in?

As you can see, the active player in this process is definitely the donor. The organization, meanwhile, is responsible for marketing matching gifts, confirming donations with employers, and acknowledging donors’ contributions.

Though your role might seem limited, it’s important that you know how this process works so you can adequately educate your supporters. Without understanding matching gifts, how will you promote them to your donors?

Bottom Line: The matching gift process is simple for donors, nonprofits, and companies alike. Nonprofits should be aware of how theses programs work, as well as the submission deadlines associated with them.

5. How can nonprofits promote matching gifts?

So, you’re on board with matching gifts and you want your donors to be, too. But how do you get the word out about these fantastic programs?

Only about 9% of donors take advantage of matching gifts. A huge majority of potential participants aren’t looking into corporate giving, and it’s your job as a nonprofit to turn those facts around!

The best way to implement matching gifts into your fundraising strategy is to be diligent in ensuring that your donors are aware of this opportunity.

There’s no end to the amount of matching gift marketing that you can do, but here are a few of our favorite places to promote these programs:

- Donation pages. Your supporter is most fully engaged in the giving process when making the initial donation, so strike while the iron is hot! Have a clearly defined call-to-action on your donation page that educates your donors on the next steps they can take to double their donations through corporate giving.

- Acknowledgement emails. You’re probably aware of how impactful a well-crafted thank-you note can be, but let’s kick it up a notch! Educate your donors on how they can make their donations go further through their employers. Remember: you want your emails to be concise and eye-catching, so don’t waste words here!

- Social media. If your donors tend to live more on their Facebook pages than in their email inboxes, you can advertise your matching gift programs on social media. These channels are a great place to include colorful images and infographics, so don’t be afraid to be visual! Most importantly, keep your posts short and sweet, and include links to more comprehensive resources.

- A matching gift challenge. See if one of your partner corporations will promote a challenge gift within their organization. For example, they can challenge their employees to donate to your nonprofit over the course of one week in order to have their gift tripled (instead of just doubled).

These tips are a good jumping-off point for where to advertise matching gifts, but you may also be wondering when you should focus your promotions on these programs.

You should keep your promotions rolling out on a regular basis, but there are some times of year that are especially ideal.

The end and beginning of the year can be a great time to remind donors of the gifts they contributed throughout the past year (and the year-end giving season). Additionally, this time of year is when many submission deadlines fall, so be diligent in making sure those match requests are submitted in time!

If you’re interested in sending more personal communications to specific donors, you can tailor your reminders depending on their individual deadlines. While this is a bit more intensive, it can pay off if you have donors whose larger contributions might be eligible to be doubled (or tripled!).

This strategy would be incredibly time-consuming if done manually. However, the right CRM can help consolidate much of the data you’ll need to pull this off and even automate some of your communications. (Still searching for a CRM that works for your organization? Take a look at this resource from Salsa!)

Bottom Line: Donors can’t maximize their donations through matching gifts if they don’t know how. By effectively promoting these programs at the right time and place, nonprofits can make the most of donors’ gifts.

6. How do nonprofits integrate matching gifts with DonorBox?

One of the most productive ways to promote matching gifts is directly on the donation form. The more information donors know as they make their contribution, the more likely they are to submit a matching request.

Nonprofits using DonorBox can easily integrate Double the Donation’s matching gift tool into their donation forms.

Moreover, donors can search for their employer and receive information about their matching gift program after confirming their donation.

Here’s how it works:

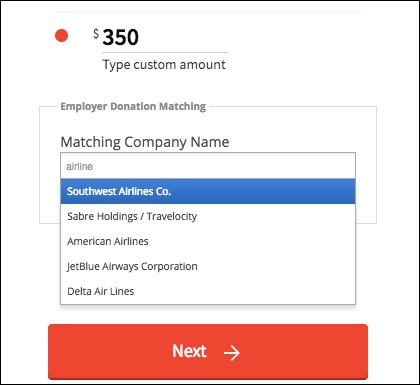

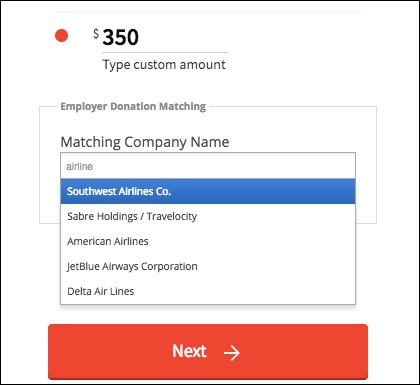

Somewhere on the donation form, usually after donors select a gift amount, there is a field where they can search for their employers. If the company is in Double the Donation’s matching gift database, it will appear in the dropdown menu shown below.

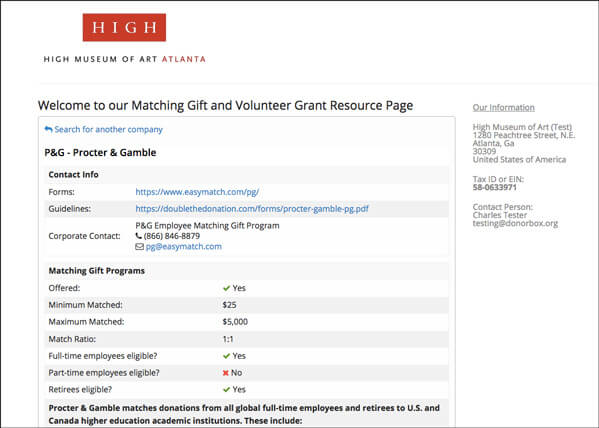

Once the donation is confirmed, donors will be directed to their company’s matching gift page, detailing the program along with the guidelines and restrictions. This matching gift page will be branded with your nonprofit’s logo, tax ID, and contact information.

Additionally, donors will be sent an email reminding them to submit a request. This email will also include a link to the matching gift page so donors can reference the information in the future.

You will also receive an email notifying you of the donors who selected a company on their donation form. With your donors’ employee information, you can tailor your communication strategy to help guide donors to finish the matching gift process.

If you’re interested in enabling this feature in your donation forms, you’ll need to login to your organization’s DonorBox account and click “Enable Donation Matching” in the company matching settings.

Make sure that your organization’s contact information and tax ID are updated so that they will display on the matching gift pages.

Bottom Line: Integrating matching gifts into your donation forms is a great way to promote giving, and it’s simple with DonorBox’s partnership with Double the Donation.

7. Can nonprofits measure matching gift performance?

The short answer is yes! In fact, being able to measure your nonprofit’s performance is essential if you want to grow your matching gift revenue.

To evaluate your progress, you’ll need to track key metrics to help you determine how many donations are successfully making it through the matching process.

With that said, you can get started by tracking the following metrics to help analyze your performance:

- Donations that are eligible for matching gifts — The first metric you should track is how many of your total donations are actually eligible for matching gifts. Since it’s unlikely that all of the donations you receive will qualify, it’s important to determine what percentage of your donations do have the potential to be doubled.

- Number of submitted requests — To determine how much money you’ve raised via matching gifts, you’ll need to track the number of donations submitted. As a result, you may find that not all of the submissions are funneling down to the gifts you actually receive. This could be because the requests aren’t meeting deadlines or requirements.

- Number of verified donations — As part of the matching gift process, your organization needs to confirm each gift was made before the corporation will send you a check. If this number is different from the number of matching gifts submitted, you could be missing out on a lot of funds. Keeping track of this metric will help you spot gaps in your own verification process.

- Amount of gifts received — This is the final and most important metric to track: keep a record of every time your organization receives a check for a matched gift. Tracking this metric will help you determine what promotional strategies are working.

Once you have enough data tracking these metrics, you can use the information to analyze your performance including information like the percentage of matching gifts received compared to eligible donations.

With these metrics, you can also determine the value of the received matching gifts. Think about it this way: if you received 20 matching gifts for $10 each, it may be a lot of gifts received, but it isn’t as valuable as one $500 matched gift.

All this information will help you see if your efforts are increasing your overall matching gift revenue. Consequently, you’ll be able to improve your strategies and keep raising more!

Bottom Line: Tracking donations and measuring your success is a great way to see what promotional methods are working and to identify any donations in the submission process that have slipped through the cracks.

8. What are some challenges organizations face with matching gifts?

Let’s face it: understanding, promoting, and tracking matching gifts is a huge endeavor that isn’t always easy. Every organization is going to face some challenges when it comes to raising money through matching gifts.

On the bright side, by getting familiar with these challenges, your organization will be better prepared to deal with any bumps along the road.

Let’s discuss two of the most common challenges nonprofits of all shapes and sizes might encounter and a few tips to help you overcome them.

Identifying Eligible Gifts

In the last section we talked about the importance of tracking and identifying eligible matching gifts, but we didn’t go into how your nonprofit can track the information.

With different giving guidelines and restrictions for every company, short of manually checking every donation, there is no simple way to identify a matching gift.

However, identifying these eligible gifts is important because it helps you pinpoint the most valuable matching gift opportunities.

But how can your nonprofit make the process a little easier?

First, your organization can hire a matching gift coordinator. This professional can focus on identifying eligible matching gifts and reaching out to donors.

Using a matching gift tool can also help your organization identify additional opportunities for your organization. By including the search tool in your donation forms and matching gifts page, you can learn more about where your donors work, which will make identifying donations much easier.

Ineffective Outreach

Organizations of all sizes have difficulties implementing proper communications strategies to encourage donors to submit a request. Even with automated emails, it can be difficult managing which donors should receive what messages.

Plus, many nonprofits don’t have a method to track the success of their outreach or which step in the process donors are at.

Lack of an effective engagement can lead to unmatched donations.

Luckily, ineffective communication can be resolved by crafting a solid communications strategy.

Create a plan that reaches out to donors multiple times to remind them about submitting a request. In your email, be sure to include:

- Information about their corporation’s matching gift program (if possible).

- A link to where donors can submit their requests.

- A tracking link that can be clicked by the donor to notify your nonprofit that a matching gift request has been submitted.

Bottom Line: While these challenges are very real concerns, you can work to solve them by creating a strong communications plan and using matching gift tools to help identify donors and track submissions throughout the process.

If you’re looking for a buy-one-get-one deal on your supporters’ donations, consider implementing matching gifts into your fundraising strategy. These programs are great for companies, even better for nonprofits, and super simple for donors to start using.

Need more information on how corporate giving works? We recommend checking out Double the Donation for all the matching gift resources you might need.

For more information on how you can promote matching gifts, check out the following helpful resources:

Matching Gift Integration: Want to learn more information about how to use matching gift tools in your DonorBox donation forms? This post provides a step-by-step guide on how to include Double the Donation’s search tool as well as more information on how it works.

Matching Gift Integration: Want to learn more information about how to use matching gift tools in your DonorBox donation forms? This post provides a step-by-step guide on how to include Double the Donation’s search tool as well as more information on how it works.

Four Forms of Corporate Giving: Did you know that there’s more than one type of giving program? Learn about the many other ways your organization can raise funds from companies and their employees.

Four Forms of Corporate Giving: Did you know that there’s more than one type of giving program? Learn about the many other ways your organization can raise funds from companies and their employees.

Marketing Matching Gifts: Promoting matching gifts is a crucial step if your organization wants to raise more funds. Learn how you can showcase matching gifts via social media, in your emails, on your website, and many more places.

Marketing Matching Gifts: Promoting matching gifts is a crucial step if your organization wants to raise more funds. Learn how you can showcase matching gifts via social media, in your emails, on your website, and many more places.