Tap into a growing donor base

More Americans own stock now than at anytime in the past 15 years. And with the average nonprofit stock donation being $5,230, now is the time to tap into this growing revenue stream.

With Donorbox’s stock donations platform, bypass the technical and organizational barriers for collecting nonprofit stock donations, and start accepting them with ease.

Book a demo to start

Finally, a stock donations platform that makes everything simple.

More Americans own stock now than at anytime in the past 15 years. And with the average nonprofit stock donation being $5,230, now is the time to tap into this growing revenue stream.

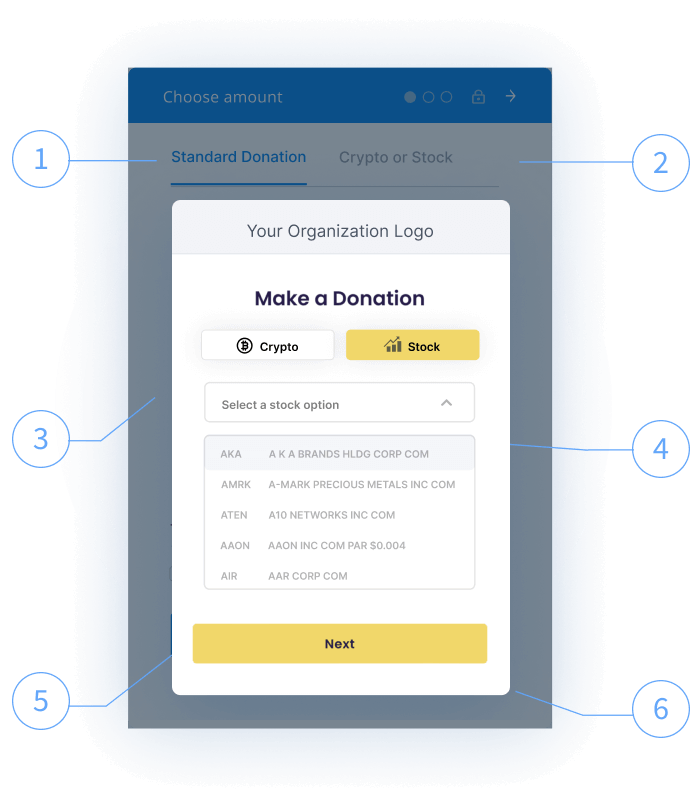

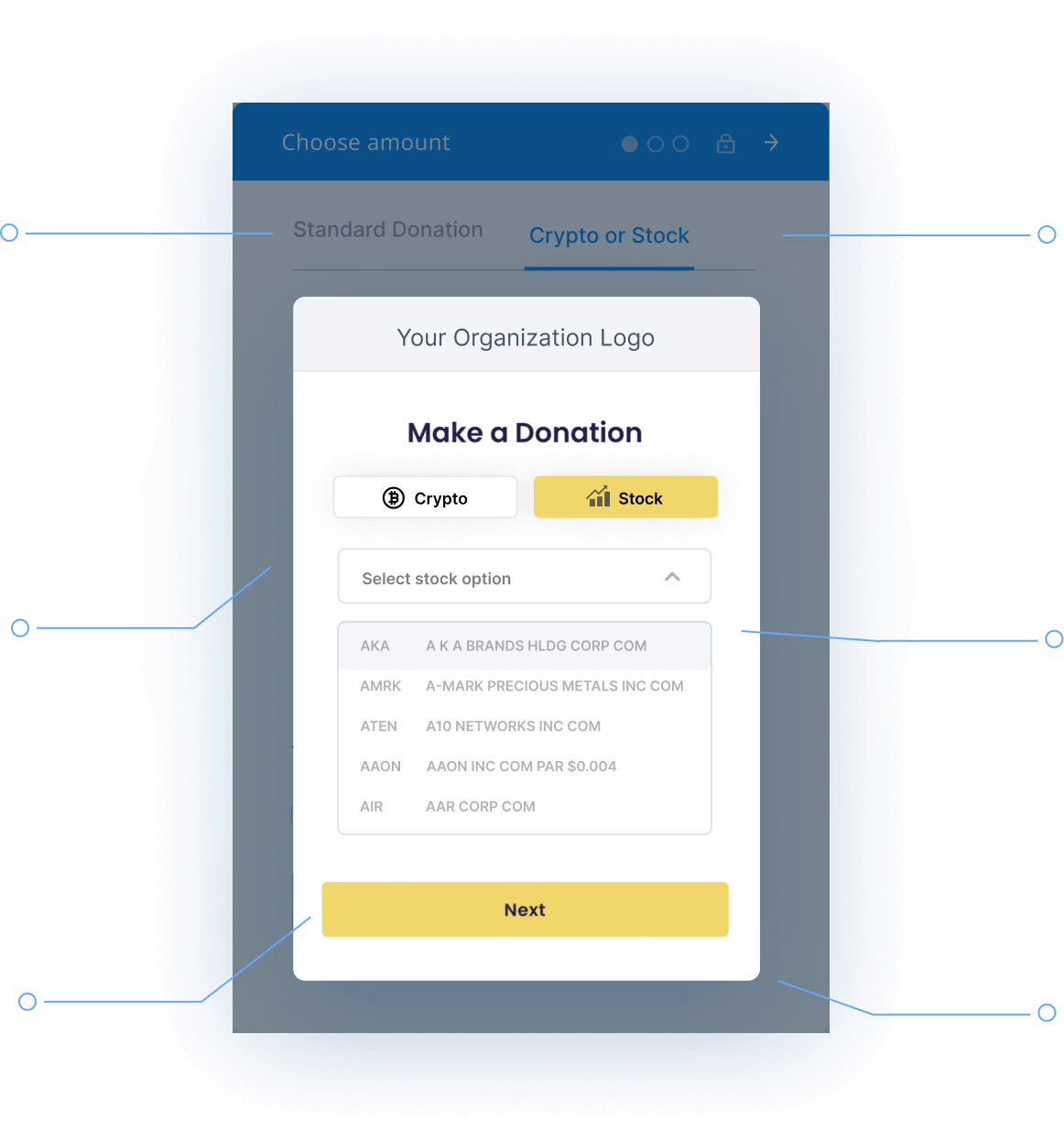

Donors can choose stock, crypto, or standard donations - all from your Donation Form - to make the giving experience hassle-free.

Stock donations provide tax advantages for donors (they pay no capital gains or state income tax) and nonprofits (maximizing impact through stock donation benefits).

A nonprofit accepting stock donations is more likely to receive a larger donation — compared to the proceeds from a donor selling the stocks themselves and then donating the cash.

Stock donations will be processed through Renaissance Charitable, the sponsoring charity for donor-advised fund programs, and will be distributed in the form of a check.

Nonprofits will receive their stock donations monthly via check. Please be aware that there must be a minimum of $50 in donations to distribute each month. If you receive under $50 in stock donations in a month, those funds will be later distributed once the minimum donation amount is reached. Additionally, nonprofits that have multiple campaigns within Donorbox will receive a consolidated check for all their stock donations.

On the check, there will be a purpose line statement that includes the date range of stock donations included. For example “5/1/23 - 5/31/23 stock donations via Donorbox”. Along with the check, you will also receive a grant letter from Renaissance Charitable, with the same purpose line included.

Currently, you can only receive your payments via check. However, we are actively working on an option to be set up for ACH payment & will update clients using the integration when live.

When a donor makes a stock donation, a receipt will be sent once the shares have been received and liquidated at Renaissance Charitable. Since Renaissance Charitable is the sponsoring charity for stock donations made through Donorbox, their information will be listed on the receipt your donor receives.

The processing fee for stock donations is 3.95%.

Some donors are inclined to optimize their tax benefits by making donations to nonprofits. By embracing donations in the form of non-cash assets, such as stocks, your nonprofit organization can attract a larger pool of donors. This approach not only expands your support base but also diversifies your sources of income.

When donors contribute appreciated stocks directly to a nonprofit organization, they can avoid paying capital gains tax on the appreciation. This means that donors can deduct the full fair market value of the donated stock on their tax returns, without having to pay taxes on the capital gains.

Donating stock can be the most efficient way to make charitable contributions by saving on potential capital gains taxes which may allow donors to give more to the causes they care about. To understand the full tax benefits of giving appreciated stock, please consult with a tax professional for information about your personal tax situation.

If you received company-distributed stock as an employee or you are subject to any trading windows or restrictions, you should consult with your company counsel on next steps before making the gift.

Most likely. If we don’t support your brokerage firm yet, you can still submit your gift. Just select “other” from the broker list and you’ll be sent a Letter of Instruction you can send to your broker firm to initiate the contribution. It's important to note that we can process gifts from the majority of brokerage firms that are capable of processing a partial stock DTC (Depository Trust Company) transfer. This option is typically available through most brokerage firms for their clients. However, certain brokerage firms like Robinhood, which do not support stock transfer, are not supported for this reason.

Yes, as a donor you would be required to process your transaction directly with your brokerage firm after selecting “other” from the list of brokers. The Giving Block will send you a Letter of Instruction which can be sent to your broker to initiate the charitable gift transfer.

Yes, you’ll be donating through a platform dedicated to security and compliance - going above and beyond to ensure your funds and privacy are protected.

It depends on several factors. The largest delay is typically your broker firm initiating the transfer of stock. But once they do, it typically takes us 2-3 business days to receive, confirm and liquidate the gift. Once the shares are liquidated the cash proceeds will be wired to the nonprofit you’ve selected. Please remember, the timeline provided is affected by end of the year transaction volume, and holidays.

If you need assistance with your donation or have general questions about the general stock donation process, please email [email protected]. If you have issues with your broker form, please contact your broker or your financial advisor/private wealth manager directly.