501(c)(8) organizations may not be the first thing you think of when imagining a nonprofit. Still, these fraternal groups are another option the Internal Revenue Service (IRS) provides to help gain tax-exempt status.

This article delves into the criteria, history, and examples of this type of organization. It also provides a few tips to help you apply to become a 501(c)(8) organization.

What is a 501(c)(8) Nonprofit Organization?

501(c)(8) organizations are fraternal beneficiary societies comprising of members who share common principles, callings, or a purpose that may go beyond social activities. These organizations must support the common good and provide benefits to their members.

501(c)(8) organizations have existed for longer than most people may expect. Fraternal organizations can be found in the United States as far back as the 19th century. Many of these organizations were founded by immigrants and other underserved populations. For many of these individuals, these organizations were the only way they could afford medical care.

The IRS first recognized these groups as nonprofits with the Tariff Act in 1909. Today, the IRS recognizes 501(c)(8) organizations as associations that operate under a lodge system that supports members with life, sick, and accident insurance, as well as other benefits.

However, 501(c)(8) organizations cannot pay directly for their members’ life, sick, accident insurance, or other benefits. They partner with insurance companies to offer insurance services instead.

The below examples are very well known for the support they give their members and their charitable actions.

Notable Examples of 501(c)(8) Organizations

- Knights of Columbus – It started as an organization of Catholic men in 1882. Members’ Catholic faith brings them together and forms the organization’s primary principles: charity, unity, fraternity, and patriotism.

- Elks – The Elks started in 1868 as the “Jolly Corks.” It was initially a collection of actors and theatre professionals. The Elks exist under the principles of charity, justice, brotherly love, and fidelity. They provide scholarships, veterans’ services, and drug awareness campaigns.

- Royal Neighbors of America – It started as a membership organization in 1895 by nine women whose aim has been to support other women and protect their members with life insurance and annuities.

- Modern Woodmen of America – This organization is a member-owned fraternal financial services organization established in 1883. They have nearly 730,000 members within the 501(c)(8) and they focus on touching lives and securing futures.

Criteria for 501(c)(8) Organizations

As you can see, many 501(c)(8) organizations have similar purposes and charity programs. Some of these come from the individual organization’s background. There are other IRS requirements to obtain and keep their tax-exempt status.

To become a 501(c)(8) tax-exempt organization, these groups must:

- Have a fraternal purpose

- Operate under a lodge system

- Provide life, sick, and/or accident insurance or other benefits to members

The IRS defines a lodge system as a group with a primary parent organization and several smaller groups underneath. Each group is self-governed, but the organization must include the same membership tiers and follow the same membership standards, rights, and privileges written down in the organization’s bylaws.

If a 501(c)(8) does not provide benefits to all its members, it will still be exempt as long as most members are eligible for the benefits and the exclusion criteria are clearly defined.

The organization must have membership standards written down, including membership tiers, the process of admission, and a list of rights and privileges.

All 501(c)(8) organizations must also offer benefits like health and life insurance, scholarships, education and travel opportunities, or discount programs for most of their members.

501(c)(8) organizations must also participate in fraternal activities like rituals, ceremonies, and social activities.

501(c)(3) vs. 501(c)(8): Similarities and Differences

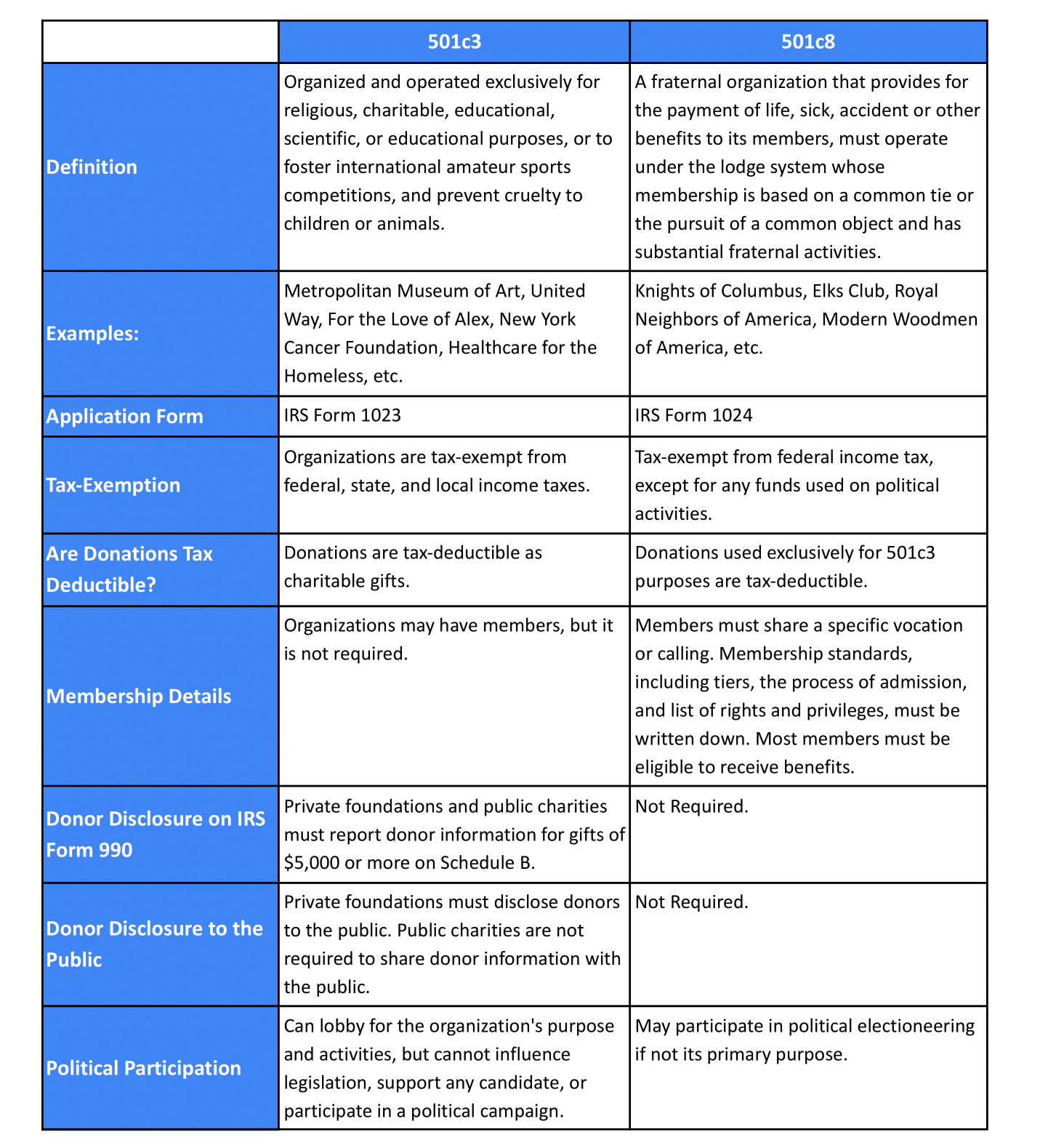

501(c)(3) organizations must operate exclusively for charitable, religious, educational, scientific, or literary purposes, or to provide testing for public safety, foster national or international sports, or prevent child or animal cruelty.

These organizations are formed to support the public, and donations to these organizations are entirely tax-deductible.

501(c)(8) organizations, on the other hand, are developed to support the organization’s members. 501(c)(8) organizations may benefit the public, but they must financially support their members through insurance and other services.

Donations to 501(c)(8) organizations are only tax-deductible if they are used for charitable purposes like those of 501(c)(3) organizations.

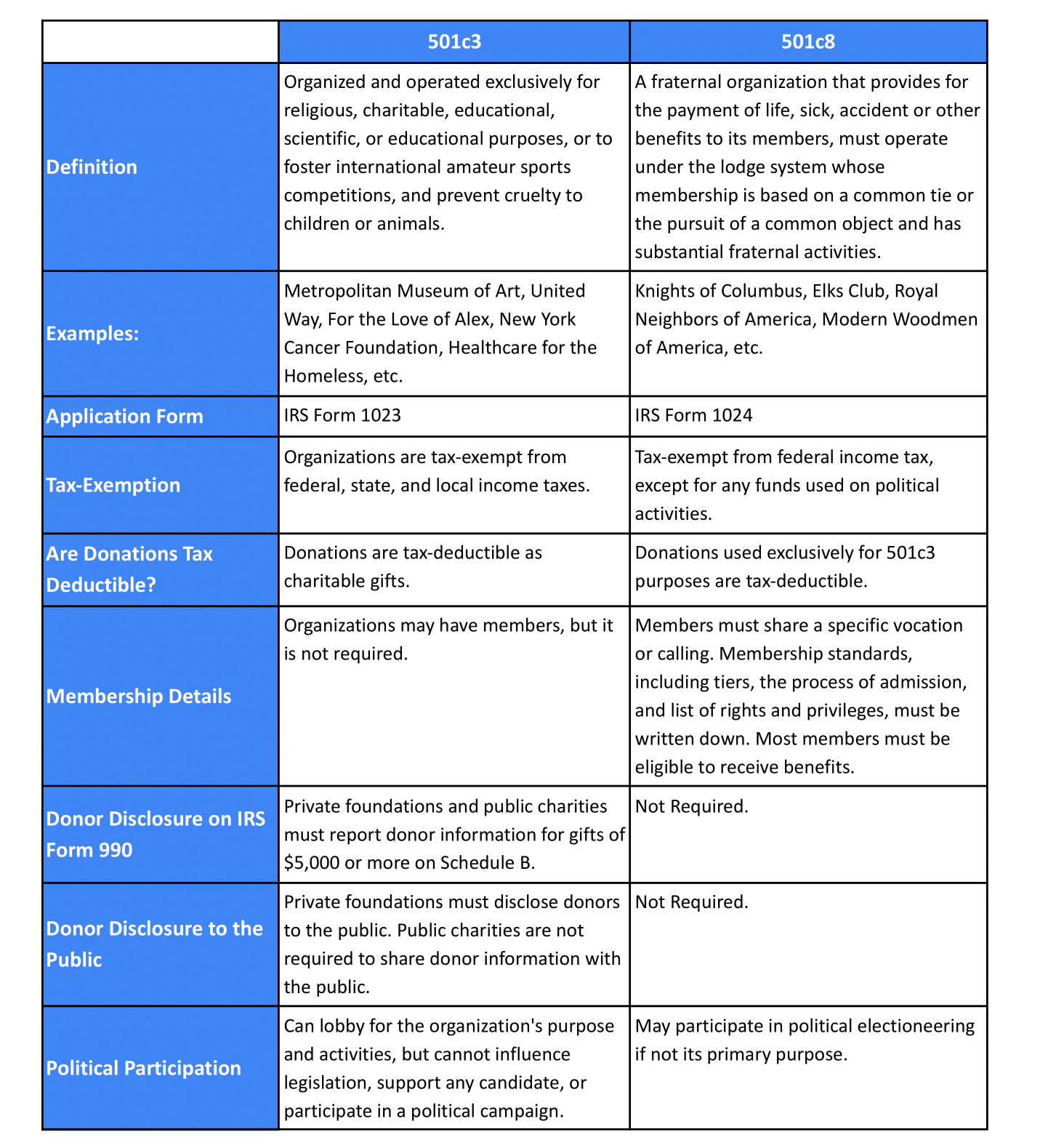

There are several other similarities and differences between the two in terms of tax exemption, membership requirements, application form, political participation, etc. The below table will help you get an insight into the comparison.

How to Start a 501(c)(8) Organization

As a 501(c)(8) nonprofit, your parent organization may have already completed many of these steps. If you are beginning a smaller group in a lodge system, be sure to contact your parent group to determine which steps you must complete.

1. Name your organization

An organization’s name can help paint a picture of what the nonprofit does and what they hope to accomplish. When choosing a name, you must stick to your state’s criteria and create a name that will be memorable and share the nonprofit’s purpose.

2. Develop a mission statement

A nonprofit mission statement is the purpose of your organization. Your mission should clearly state what your nonprofit does and how it helps solve a problem. You will use your mission statement to spread the word through marketing pieces about the work of your nonprofit.

3. Start a board

As soon as you can, you’ll want to form a Board of Directors to help finalize your mission (purpose) and bylaws. Your board members are your leadership team and should be willing and able to support the organization’s operational and fundraising efforts.

4. Finalize your bylaws

When forming your organization’s bylaws, you must keep a few things in mind. If your organization is a smaller part of a lodge system, your bylaws may be the same as your parent organization. The IRS does allow individual lodge members to self-govern, so you can also create your own bylaws.

If you choose to form your own bylaws, remember to include the following:

- Organization’s name and purpose

- Board elections, term limits, role descriptions, and responsibilities

- Membership information

- Board meeting frequency and quorum

- Indemnification of board members

- Conflict of Interest

- Bylaw amendment

- Organization dissolution information

5. Apply for an EIN

Before applying for tax-exempt status with the IRS, a 501(c)(8) organization must apply for an Employer Identification Number (EIN) even if you do not plan on hiring employees. You’ll need this number to fill out IRS form 1024.

6. Apply with Form 1024

Generally, organizations that want to claim a tax exemption must file Form 1024 with the IRS. Unlike 501(c)(3) organizations, though, there is no deadline to file for tax-exempt recognition. Still, if your organization has not received your letter of determination from the IRS, you must file tax form 990.

Lodges must be recognized by the parent organization to be tax-exempt. Contact your parent group to ensure they include you in their 990s. Lodges are responsible for providing parent organizations with the required information on a 990.

Final Thoughts

501(c)(8) organizations have an impressive history. Many immigrant groups and underserved populations needed their support for medical and other essential needs. 501(c)(8) organizations continue to provide this vital support for their members.

All nonprofits need to raise funds. Like 501(c)(3) organizations, 501(c)(8) nonprofits can collect donations if they are used for charitable programs.

If your nonprofit wants an affordable way to raise funds and manage donors online, visit our website to learn more about the Donorbox platform. Donorbox offers simple-to-use fundraising features for nonprofits of all types, including Recurring Donation Forms, Customizable Donation Pages, Crowdfunding, Peer-to-Peer fundraising, Events, Memberships, Text-to-Give, and more.

Our Nonprofit Blog offers tips and resources to help run your nonprofit better and raise more funds online. Subscribe to our newsletter to receive a list of our most helpful resources every month in your inbox.

Frequently Asked Questions (FAQs)

1. What is the difference between a 501(c)(10) and a 501(c)(8)?

Although both 501(c)(8) and 501(c)(10) organizations operate under a lodge system, there are several differences between the two.

501(c)(10) organizations are fraternal but cannot provide their members with life, sick, accident, or other benefits. 501(c)(10) must also be formed in the U.S., and their net earnings must be devoted entirely to fraternal or tax-exempt purposes like in a 501(c)(3).

2. What is the difference between 501(c)(7) and 501(c)(8) organizations?

On the surface, 501(c)(7) fraternal organizations like college fraternities may seem the same as 501(c)(8) nonprofits, but they are drastically different.

501(c)(7) are social clubs for pleasure, recreation, and other nonprofitable purposes. They also do not operate under a lodge system.

Finally, 501(c)(7) nonprofits may also encounter more restrictions than 501(c)(8) and 501(c)(10) organizations.

3. What if my 501(c)(8) stops providing life, sick, and accidental insurance or other benefits to its members?

If a 501(c)(8) stops providing benefits, it can still remain tax-exempt. They can reclassify as a 501(c)(10) as long as they still act under the lodge system and meet other requirements.

Note: By sharing this information we do not intend to provide legal, tax, or accounting advice, or to address specific situations. The above article is intended to provide generalized financial and legal information designed to educate a broad segment of the public. Please consult with your legal or tax advisor to supplement and verify what you learn here.