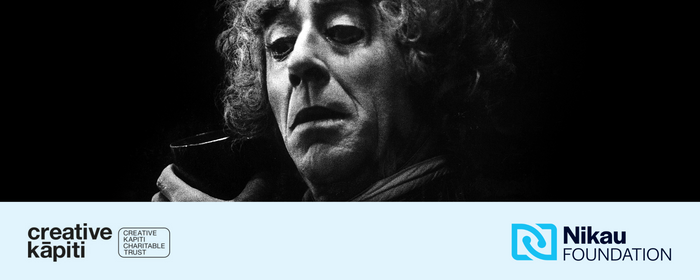

Sir Jon Trimmer Scholarship Fund

Give a gift today, to support future generations of performing and visual artists in Kāpiti, forever.

Established in 2024 following the death of legendary dancer, Sir Jon Trimmer, Nikau Foundation's Sir Jon Trimmer Scholarship Fund will offer transformative opportunities for local Kāpiti performing and visual arts practitioners long into the future. Overseen by the Creative Kāpiti Trust, these scholarships will ensure that Sir Jon’s generosity, inspiration and encouragement for other performing and visual artists will continue to be felt for generations to come.

All donations given to the Sir Jon Trimmer Scholarship Fund will be responsibly invested and grown to support performing and visual artists, forever.

Be the first person to support this project and make a donation!