Tap into a growing donor base

Crypto donations to charities have never been more popular. And with the average crypto gift at $10,455, now is the time to tap into this growing revenue stream.

Grow your revenue and donor base by including crypto donations on our flagship donation form.

Book a demo to start

Crypto donations to charities have never been more popular. And with the average crypto gift at $10,455, now is the time to tap into this growing revenue stream.

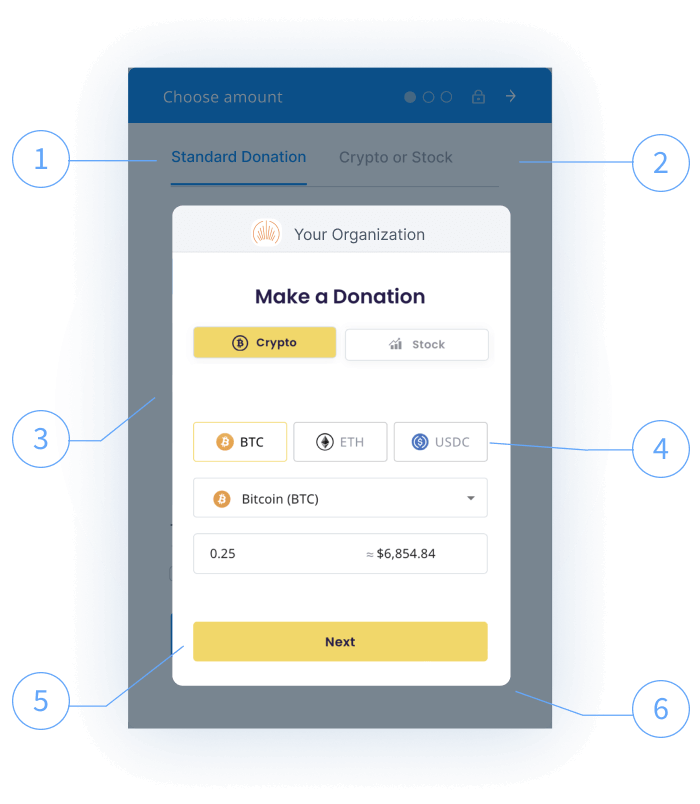

Donors can choose from crypto, stock or standard payments - all from your Donation Form - to make the giving experience smooth and simple.

Crypto donations provide tax advantages for donors (they pay no capital gains or state income tax), meaning that for every $10,000 given, donors can save up to $3,000 or more on taxes.

Crypto donations offer a completely private and anonymous option for donors to give to your organization - removing potential roadblocks and widening your donor pool.

Donation will be processed via Renaissance Charitable, the sponsoring charity for donor-advised fund programs. Nonprofits will receive checks for these donations.

Renaissance Charitable will send checks for your crypto donations on a monthly basis. There is a minimum donation amount of $50 required every month for them to distribute checks. If your organization doesn’t meet this criterion in a particular month, you’ll be sent a check later when your donation amount has reached $50. Additionally, nonprofits that have multiple campaigns within Donorbox will receive a consolidated check for all their crypto donations.

On the check, there will be a purpose line statement that includes the date range of donations included. For example “5/1/23 – 5/31/23 crypto donations via Donorbox". Along with the check, you will also receive a grant letter from Renaissance Charitable, with the same purpose line included.

Currently, you can only receive your payments via check. However, The Giving Block is actively working on a way to set up ACH payments with cryptocurrency donations. You’ll be notified when this option is available.

Yes. Your donors will receive automated receipt emails after they’re made a crypto donation. Since Renaissance Charitable is the sponsoring charity for cryptocurrency donations made through Donorbox, their information will be listed on the receipt your donor receives.

The donation processing fee for crypto donations will be charged by The Giving Block at 3.95%.

Some donors are inclined to optimize their tax benefits by making donations to nonprofits. By embracing donations in the form of non-cash assets, such as cryptocurrency, your nonprofit organization can attract a larger pool of donors. This approach not only expands your support base but also diversifies your sources of income. Additionally, crypto adoption has skyrocketed over the past decade, particularly with millennials, and has become a popular way for younger donors to support causes they care about.

Yes, in most cases, donating crypto allows for the same write off as a cash gift.

Yes, there is an option for donors to submit only an email address in order to receive an automatic donation receipt that can be used for tax filing purposes.

You’ll need a digital wallet that supports the specific cryptocurrency you wish to donate. You can then transfer the desired amount of crypto to the provided wallet address of the nonprofit or organization you want to support.

Over 200 cryptocurrencies are accepted for donation, including Bitcoin, Ethereum, Litecoin, Dogecoin, Avalanche, Polygon, PAX Gold, Samoyedcoin, Tether, Galxe, and many more.

Crypto transactions are recorded on the blockchain without revealing personal information. However, some organizations who accept crypto donations may require donor information for compliance purposes.

Yes, cryptocurrencies are highly divisible. You can specify the exact amount you wish to donate, even if it's a fraction of a whole unit.